The Bank of Canada's job isn't done—judging from the hike and a half now priced into the #OIS# market this year.

Markets see what the BoC sees: stubborn perkiness in labour, services and housing markets, with core inflation plateauing.

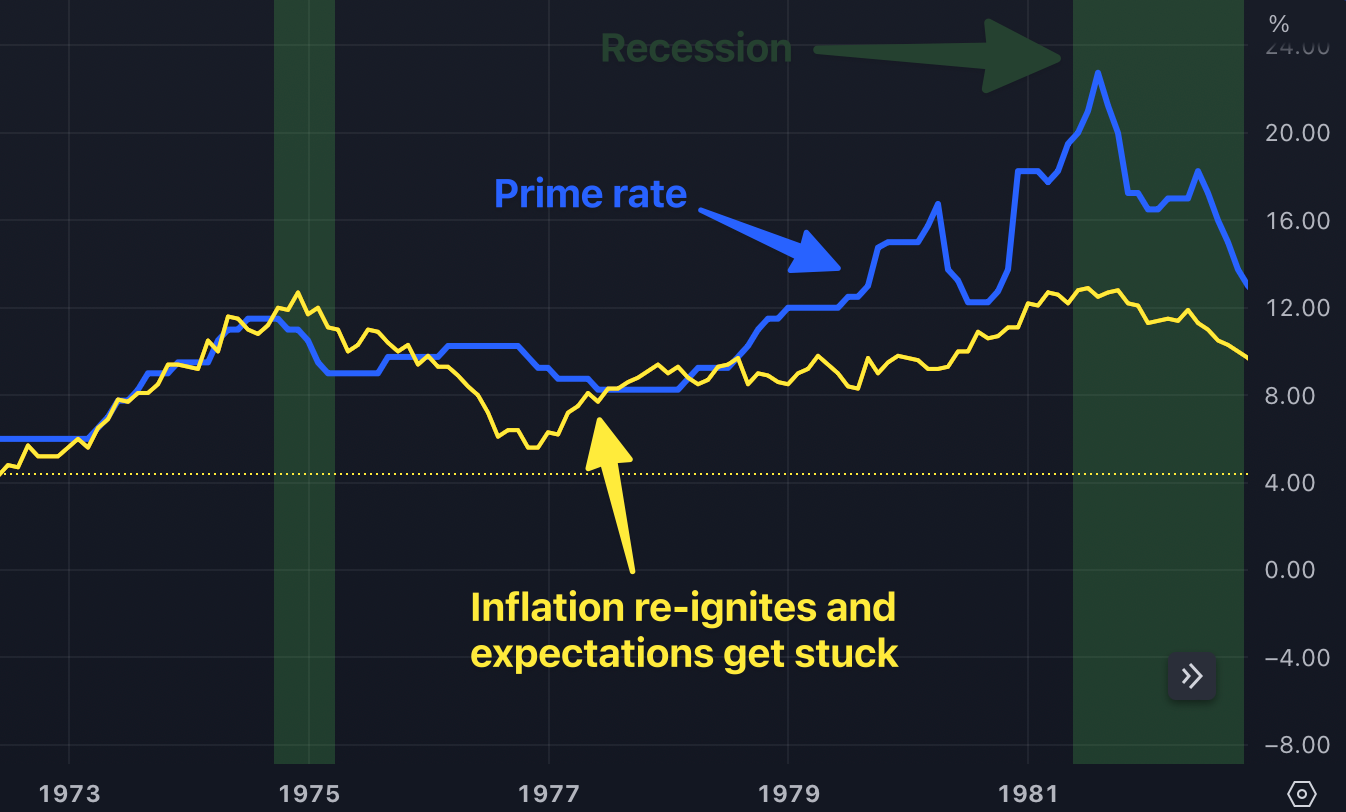

The Bank of Canada knows rates are restrictive but worries they're not restrictive enough. Real rates are still low compared to pre-#GFC# rate cycles. And if the late 1970s (chart above) taught central banks anything, it's that they can afford only so much patience with lagging monetary effects—before running the risk of inflation expectations re-igniting. A dangerous scenario like that could drag out this hiking cycle far longer than necessary.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.