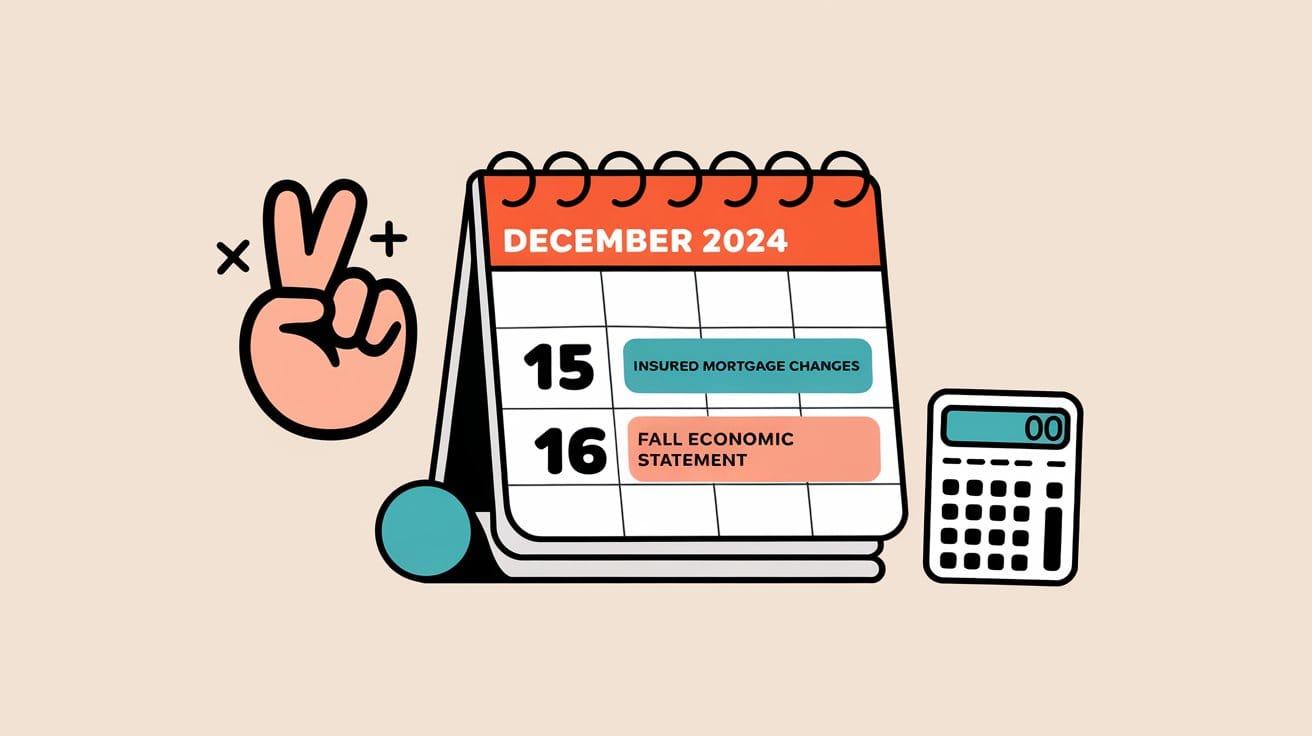

In a win for lenders and consumers alike, the government is amending the mortgage insurance rules to eliminate its mortgage stress test on low-ratio (a.k.a. "bulk insured") mortgages that switch from a federally regulated lender to any other lender at renewal.

The move, which is effective today, December 16, lets insurable borrowers with higher #GDS#/#TDS# ratios play the field at renewal. These low-ratio mortgagors can now switch to the most competitive lenders and qualify at the contract rate instead of their contract rate plus 200 bps (or 5.25%, whichever is higher).

The change is significant for renewing borrowers who were trapped by the stress test. The reason is, the insurable rates they'll now have access to are often better than:

(A) uninsured rates (especially on lower LTV loans), and

(B) low-ratio renewal offers.

That said, lenders we speak to don't expect tremendous uptake, given high customer retention rates and increasingly competitive renewal offers.