MLN Alerts

MLN Stream

Forget Bay Street's stuffy suits - Community Savings is the biker gang of credit unions, roaring down the mortgage highway with advertised rates that'll make a banker's toupee fly off. We're talking the likes of 3.99% on a five-year fixed. Given

How Community Savings is Outgrowing Rivals

Forget Bay Street's stuffy suits - Community Savings is the biker gang of credit unions, roaring down the mortgage highway with advertised rates that'll make a banker's toupee fly off. We're talking the likes of 3.99% on a five-year fixed.

Given its aggressive pricing, it's not surprising that Community Savings is growing at a 10% annualized clip, 2.4 times the growth rate of credit unions overall.

To see what makes it tick, we spoke with Mike Schilling, President & CEO. He touched on:

- Why/how the CU prices so aggressively

- What drives fixed and variable discounts

- The capital benefit of insured mortgages

- Regulatory capital changes in B.C.

- How credit unions like his haven't stress-tested switches for years

- The lack of sophistication in policymaking for insurable mortgages

- Pricing non-parity in his retail and broker channels

- How consolidation hurts rural mortgage customers.

The video and transcript are below...

Back to topTiff Macklem is in the crosshairs of Bay Street's prophets. Economists are ganging up on the central banker, claiming he's so far behind the curve, he's practically lapped himself.

Canada's Real Policy Rate is Screaming for a Half-Point Rate Cut

Tiff Macklem is in the crosshairs of Bay Street's prophets. Economists are ganging up on the central banker, claiming he's so far behind the curve, he's practically lapped himself.

Back to topMost prime mortgage borrowers want the answer to one not-so-simple question: Which mortgage is going to save me the most money if rates pan out as the experts expect? MLN now provides that answer—lickety-split. As part of our new Rate Simulator dashboard page, you'll find a fresh

NEW: Amortization Simulator 3.0 (Beta)

Most prime mortgage borrowers want the answer to one not-so-simple question: Which mortgage is going to save me the most money if rates pan out as the experts expect?

MLN now provides that answer—lickety-split.

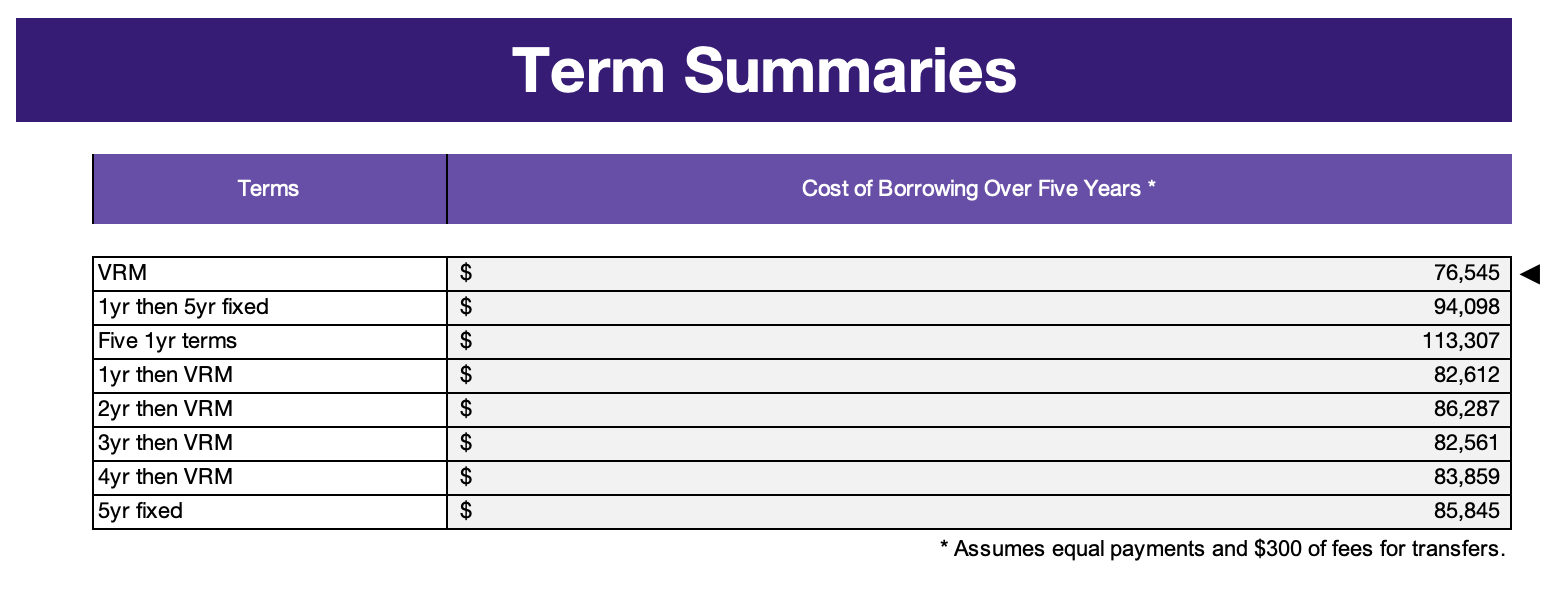

As part of our new Rate Simulator dashboard page, you'll find a fresh little gizmo called Term Summaries. Here's a screenshot.

What you're looking at here is a cost comparison of the most competitive mortgage term combinations over five years. They're based on the lowest nationally-advertised rates (which you can change) and the market's implied rate outlook.

To ensure apples-to-apples comparisons, we assume equal payments regardless of the term (i.e., all payments are set to equal the mortgage with the highest rate). This eliminates concerns about cash flow differences and the time value of money.

Term Comparisons

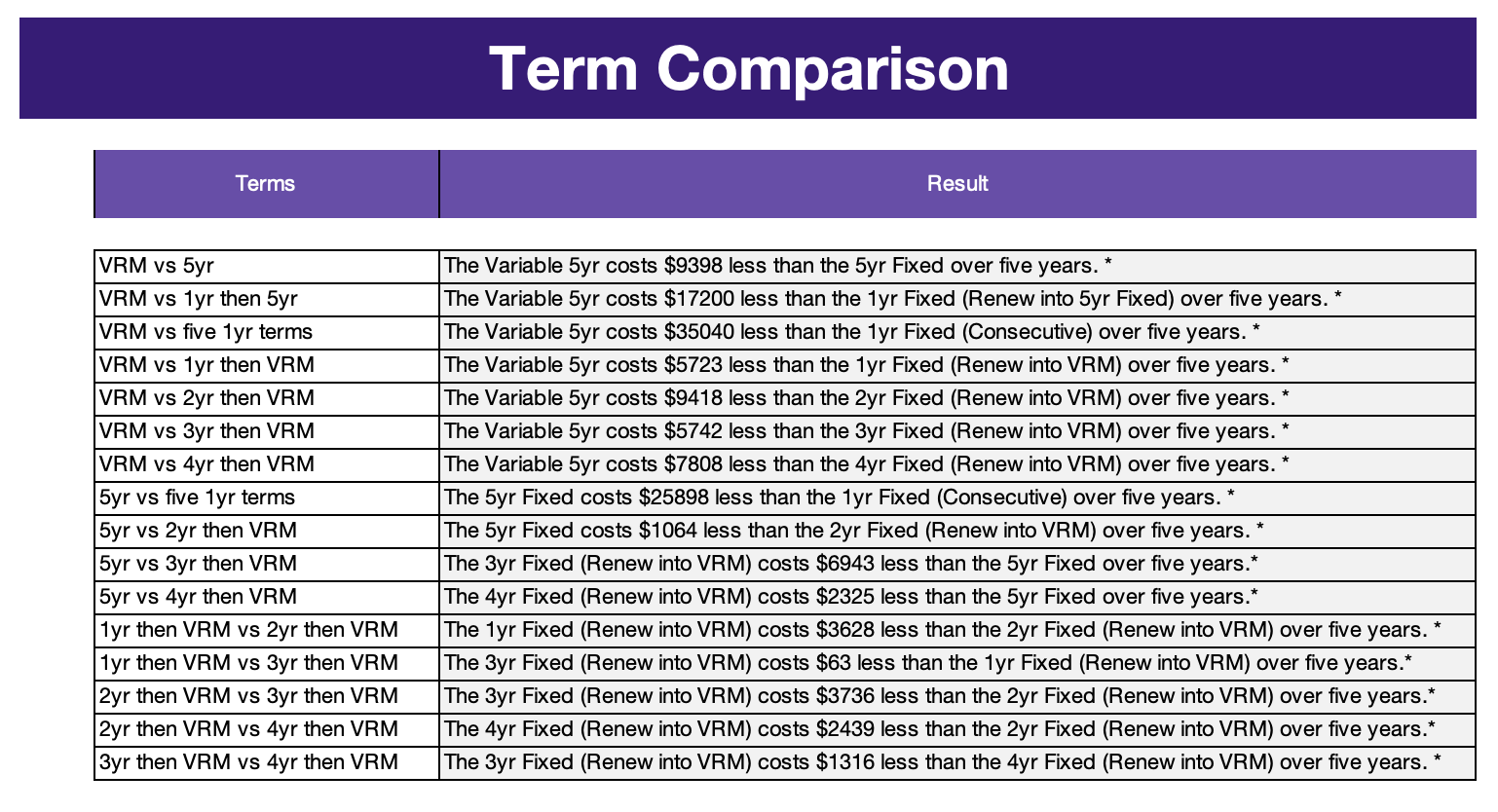

You might also have clients who want an opinion on one term over another. To make that easy, MLN's new rate sim compares the most popular term combinations head-to-head. Example below.

You can also:

- See detailed calculations for each of these scenarios on the respective tabs in the spreadsheet

- Quickly change rate assumptions throughout the spreadsheet from the "Home" tab (without going to each tab, like in the old version)

- Alter the rate outlook to create the most relevant scenarios for your clients

- Enter your own starting mortgage rates, depending on what rates you have access to

- Change the rate assumptions at renewal:

- The "VRM at Renewal (prime discount)" is simply the variable-rate mortgage discount borrowers might expect at renewal

- The "1-year swap" rates seen here are used to estimate the renewal rates for one-year fixed terms (advanced)

- The "4-year swap in 12 months" is used to estimate how 5-year fixed rates could change one year from now based on market expectations.

This latest version (version #49) also has the latest forward rate outlook built in.

Clients eat these projections up, by the way—especially when you explain them on a screen share and do some best-case-worst-case analysis. It's like mortgage market tarot cards, but with actual math behind it. So, fire up Amortization Simulator 3.0 today (download here).

Mortgage Bytes

- Economist shuffle: Most mainstream economists have now pivoted their Oct. 23 BoC forecasts to a 50 bps cut. Over in the #OIS# market, a 50-basis-pointer in seven days is now a 3 in 4 (76%) implied probability. Easing of that magnitude would meaningfully improve the odds of a quicker return to Canada's 2.75% +/- #neutral rate#.

- Profit vs. loss: It's hard to find a starker contrast in mortgage stocks than DLC Group and Pineapple. Team DLC has been crushing it, posting $4.1 million of net income in Q2 and almost doubling the stock price year-to-date. Pineapple, God love 'em, had a net loss of $848,605 in its last reported quarter and saw two-thirds of its stock value evaporate.

Job numbers on both sides of the border have thrown rate expectations for a bit of a loop. Nowhere is that more evident than in the 4-year swap market, which we refer to as a rough indicator of base fixed-mortgage funding costs.

Employment Data Shakes Rate Cut Confidence

Job numbers on both sides of the border have thrown rate expectations for a bit of a loop. Nowhere is that more evident than in the 4-year swap market, which we refer to as a rough indicator of base fixed-mortgage funding costs.

Back to topTwo days into the start of FINTRAC’s requirements for mortgage brokers, it's clear this is going to take some getting used to. The regs (details on those) took effect in the broker channel on Friday. Thanks to all the new anti-bad-guy procedures, brokers have the joy of

FINTRAC Makes Every Mortgage Broker a Compliance Officer

Two days into the start of FINTRAC’s requirements for mortgage brokers, it's clear this is going to take some getting used to.

The regs (details on those) took effect in the broker channel on Friday. Thanks to all the new anti-bad-guy procedures, brokers have the joy of extra paperwork plus the thrill of paying more for the privilege.

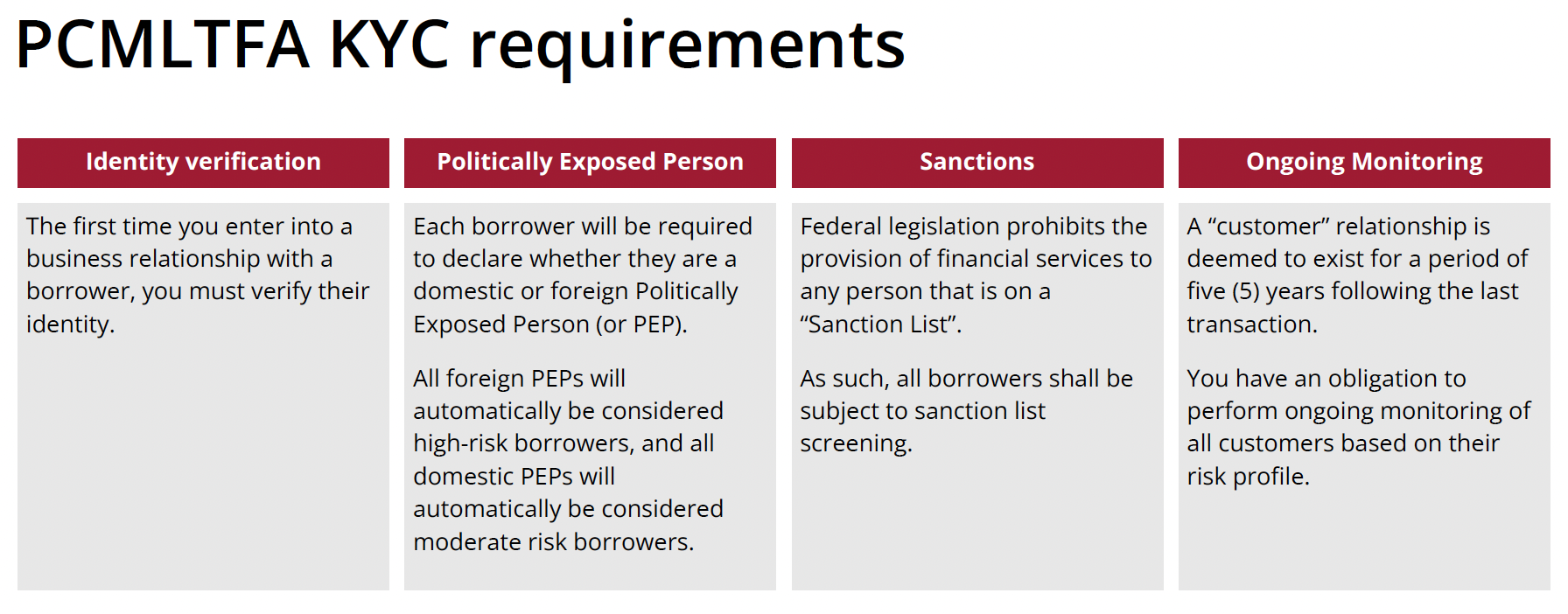

Here's a summary of broker obligations from Equifax:

For some brokers, even those who took FINTRAC courses, there's still ample uncertainty and unanswered questions. We’ll bug the regulator with questions this week—chime in below if you've got your own.

As for deal management systems (a.k.a. POS systems), they all offer a different interface for complying with the above, and no one of them is perfect. Here's a quick rundown of what we've dug up so far...

Back to top