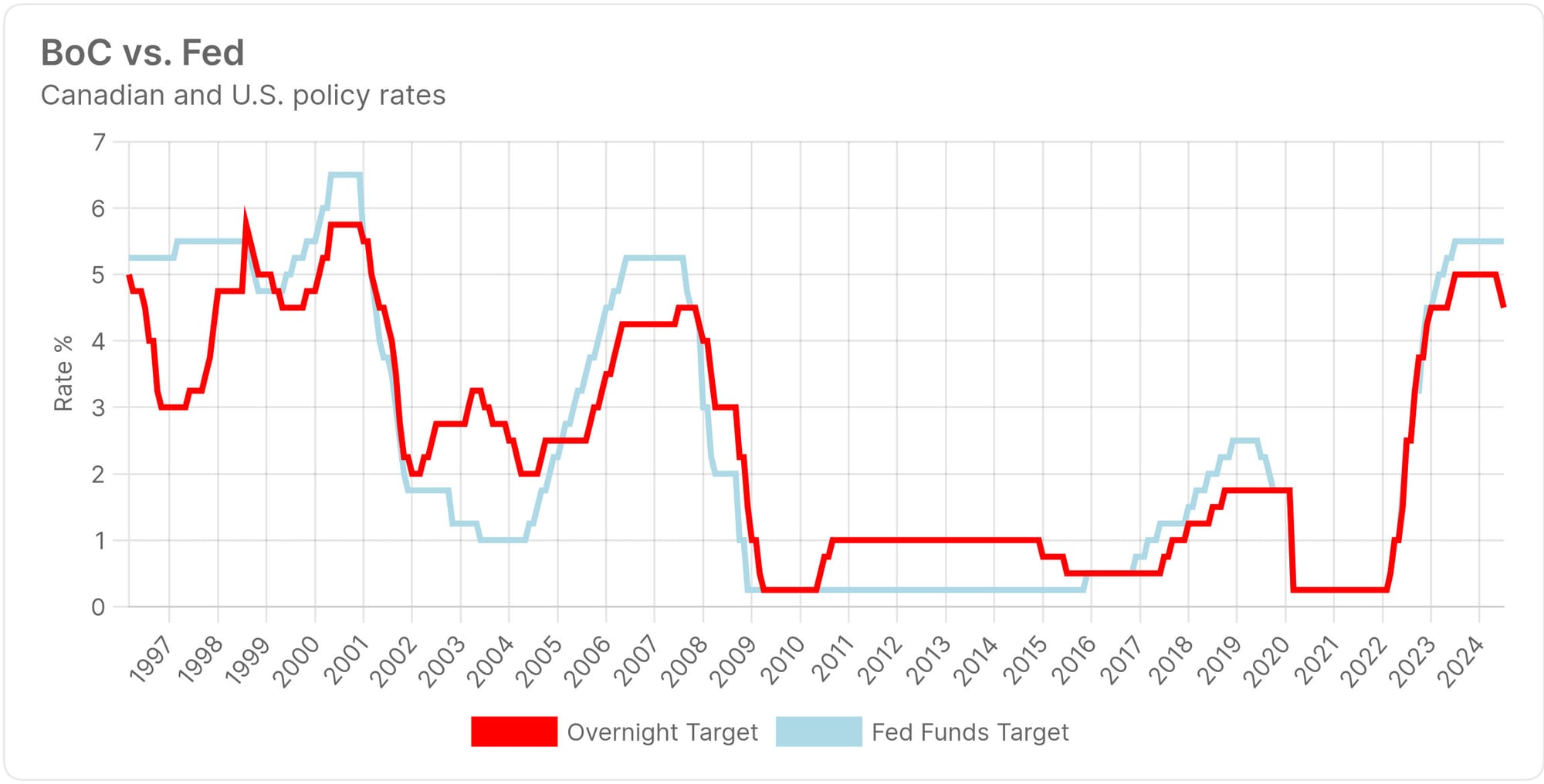

Canada's rate outlook shifted a bit after Wednesday's BoC rate cut, and that shift benefits rate floaters.

To paint the picture, here's a hot-off-the-press chart of the forward rate outlook from CanDeal DNA.

Back to topCanada's rate outlook shifted a bit after Wednesday's BoC rate cut, and that shift benefits rate floaters. To paint the picture, here's a hot-off-the-press chart of the forward rate outlook from CanDeal DNA.

Canada's rate outlook shifted a bit after Wednesday's BoC rate cut, and that shift benefits rate floaters.

To paint the picture, here's a hot-off-the-press chart of the forward rate outlook from CanDeal DNA.

Back to topCanada's stretched-thin homeowners caught another break from our central Bank today. Team Macklem dialled back the overnight rate to a breezy 4.50%, setting up a drop in benchmark prime to 6.70% tomorrow. The move will:

Canada's stretched-thin homeowners caught another break from our central Bank today. Team Macklem dialled back the overnight rate to a breezy 4.50%, setting up a drop in benchmark prime to 6.70% tomorrow.

The move will:

Back to topArtificial intelligence isn't new to Canada's mortgage industry. It's been around since at least the mid-1990s. CMHC was an early adopter of AI-like systems in 1996 with its revolutionary emili automated default insurance underwriting system. emili zapped approval times from snail-paced days to lightning-fast

Artificial intelligence isn't new to Canada's mortgage industry. It's been around since at least the mid-1990s.

CMHC was an early adopter of AI-like systems in 1996 with its revolutionary emili automated default insurance underwriting system. emili zapped approval times from snail-paced days to lightning-fast seconds. For mortgage consumers and originators, it was like going from dial-up to broadband.

For most mortgage professionals, the real "aha" moment for AI didn't hit until 2023. That's when ChatGPT changed the game. By leveraging high-power chips and training its sophisticated model with massive datasets, AI could instantly process answers based on billions of parameters.

Fast forward to today, and, for the first time, AI is creating possibilities like self-teaching automated underwriting bots, predictive default analytics based on a borrower's entire online profile, and eerily human-like voice-based advice.

To delve into how AI is changing mortgage lending, we spoke with Subodha Kumar, Ph.D., the Paul R. Anderson Distinguished Chair Professor at Temple University. Kumar's specialty is AI disruption, including in the mortgage business. He's been ranked #1 worldwide for publishing in Information Systems Research.

"We've partnered with some of the largest banks in the world, like TD Bank and Wells Fargo," Kumar says. As we speak, he's helping those banks harness AI to radically improve the customer experience and shave millions in costs.

From his treasure trove of experience, Kumar gave MLN a peek at seven AI game-changers for the mortgage business.

Heading into this week's rate council huddle at the Bank of Canada, mortgage borrowers wield four pressing questions. Let’s unpack those with some likely answers.

Heading into this week's rate council huddle at the Bank of Canada, mortgage borrowers wield four pressing questions. Let’s unpack those with some likely answers.

Back to topSo here we are extolling the virtues of variable and 3-year fixed rates, and along comes this 'bombshell' from the Globe and Mail: Why two-year fixed-rate mortgages are now the best option for homebuyers The author, a respectable long-time personal finance writer, states: "The best time to

So here we are extolling the virtues of variable and 3-year fixed rates, and along comes this 'bombshell' from the Globe and Mail:

Why two-year fixed-rate mortgages are now the best option for homebuyers

The author, a respectable long-time personal finance writer, states:

"The best time to have taken out a three-year mortgage was a year ago. Today, shorter is better, and flexibility is the name of the game. Two-year fixed-rate mortgages are the new ideal option for borrowers looking to take full advantage of incoming lower rates."

Oh snap!

Have we been championing variables and 3-year fixed rates for months in error?

Sweet Mother Mary, no.

Turns out, this story has some alternative facts. Luckily, math and history keep things real.

Back to topWhat would a lifelong interest rate trader pick for his mortgage? We wanted to find out, so MLN spoke with Kevin Abarbanel last week. Abarbanel is a former head futures trader for BMO Nesbitt Burns. He's been trading short-term interest rate futures full-time for over three decades, longer

What would a lifelong interest rate trader pick for his mortgage? We wanted to find out, so MLN spoke with Kevin Abarbanel last week.

Abarbanel is a former head futures trader for BMO Nesbitt Burns. He's been trading short-term interest rate futures full-time for over three decades, longer than virtually anyone else in Canada.

Abarbanel's own trades were responsible for over 10% of BAX futures trading volume for over a decade. If there's anyone who knows what drives Canadian interest rate markets, it's him.

Back to top