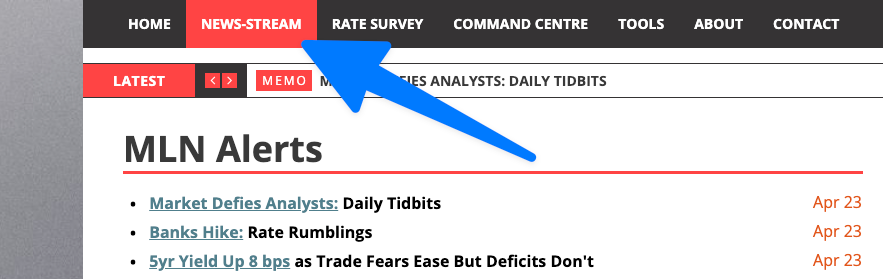

MLN has just completed major reconstructive surgery on the News-Stream page. It's now the new express lane for all of MLN's mortgage updates.

News-Stream is particularly handy if you like to scroll on your phone like it's a morning paper. You can give it a whirl here and slap a bookmark on it if you like.

These are all the newest features:

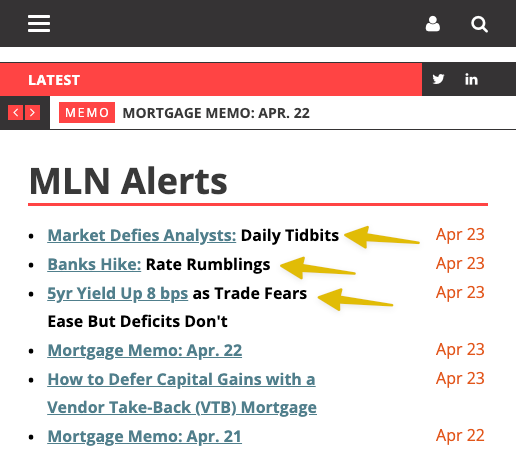

- News alerts — Bulletins are now listed as quick, easy-to-scan headlines that play nicely on a mobile phone.

- More timely reporting — There's no more need to wait for full stories before we publish. Going forward, bulletins will go out as important news breaks. That means multiple updates throughout the day.

- Timestamps — Bulletins are now displayed in timestamped order.

- Faster navigation — To get around:

- Click a headline to jump quickly to the story.

- You'll see a short intro to the article.

- If you want to read on, click on the image or the "Read More..." link.

- If you want to go back to the top, click "Back to Top."

- Updateable stories — We know that some members preferred the full stories by email, but alas, this prevented MLN from getting stories out quickly (because we can only send one version and email per day). Unfortunately, there were also cases where the emails were being shared with non-MLN Pro professionals, which isn't cool for other members. And lastly, emailing full stories prevented them from being updated with vital new info, since we can't change what's already in someone's inbox.

- Daily summary — To spare your inbox from a digital snowstorm, we'll dispatch a single update at the end of each business day, neatly bundling all the day's bulletins. This kicks off today, April 24 (click here to see April 23's bulletins).

The News-Stream page is a live beta that'll keep getting optimized. If you've got thoughts, sharp opinions, or just want to say “why is this font judging me,” fire them off in the comments or email here.

We hope you enjoy it!

Back to top