MLN Alerts

MLN Stream

Rocket Mortgage Canada, the Canadian sibling of U.S. lending giant Rocket Mortgage, will soon allow 3rd-party brokers to submit deals. The company is launching its new broker division, dubbed Rocket Mortgage Pro, next week. It's doing so with brokers from a single firm to start: BRX Mortgage.

Rocket Mortgage Opens Up to 3rd-Party Brokers

Rocket Mortgage Canada, the Canadian sibling of U.S. lending giant Rocket Mortgage, will soon allow 3rd-party brokers to submit deals.

The company is launching its new broker division, dubbed Rocket Mortgage Pro, next week. It's doing so with brokers from a single firm to start: BRX Mortgage.

The move is just the latest in a trend of direct-to-consumer (DTC) discount lenders diversifying their originations into the broker channel.

What follows is MLN's take, along with a deep dive into what makes Rocket Mortgage Pro tick.

Back to top5% cashback mortgages are the Rodney Dangerfield of lending—they get no respect. Critics pan their higher rates and the fact borrowers have to pay back the cash rebate (typically pro-rata) if they break the mortgage early. Yet, for the right borrower, these maligned products are a sleeper hit. In

5% Cashback Magic

5% cashback mortgages are the Rodney Dangerfield of lending—they get no respect. Critics pan their higher rates and the fact borrowers have to pay back the cash rebate (typically pro-rata) if they break the mortgage early.

Yet, for the right borrower, these maligned products are a sleeper hit. In fact, cashback mortgages are probably undersold. Here's why.

Back to top💡Don't miss the CMLS rumour in today's Mortgage Bytes (below). When employment's on fire, mortgage rates can catch the spark. And while today's jobs report may not have been a raging inferno (growth is expected given massive population growth), it was hot

Good News on Employment (For Those Who Don't Prefer Low Rates)

When employment's on fire, mortgage rates can catch the spark. And while today's jobs report may not have been a raging inferno (growth is expected given massive population growth), it was hot enough to take yields up and kick borrowers' rate-cut dreams into July.

Here's how it shook out:

Back to top📰Also in this edition: • Capitalizing on consumer mortgage trends • Mortgage Bytes If we had a chart of the week, it would be this one. Citigroup's U.S. economic surprise index (chart above) has turned negative for the first time in well over a year. A reading below zero

A Popular Indicator Flashes Red

• Capitalizing on consumer mortgage trends

• Mortgage Bytes

If we had a chart of the week, it would be this one.

Citigroup's U.S. economic surprise index (chart above) has turned negative for the first time in well over a year. A reading below zero means the U.S. economy is in worse shape than expected. Surprise index readings start falling fast when America's economy declines, and the last few weeks have seen a steep drop.

For Canadians eyeing mortgage rates, this matters—because when Uncle Sam sneezes, we reach for the tissues. Some like to think we control our own destiny north of the 49th. But the truth is, the overstimulated U.S. economy must decelerate to give Canadians a fighting chance at 3-handle mortgage rates.

Back to top💡Also in this edition: • Home Buyers' Plan Strategies Last month, the government excitedly announced it was jacking up the RRSP Home Buyers' Plan (HBP) withdrawal limit from $35,000 to a roomier $60,000. That made us and many others wonder: who's actually benefiting from this

New $60,000 Home Buyers' Plan Limit: Affordability Game Changer or Just More Frosting?

• Home Buyers' Plan Strategies

Last month, the government excitedly announced it was jacking up the RRSP Home Buyers' Plan (HBP) withdrawal limit from $35,000 to a roomier $60,000.

That made us and many others wonder: who's actually benefiting from this $25,000 higher limit?

MLN pinged the Canada Revenue Agency (CRA) for some hard numbers. Here's what they told us.

Back to top

It's an all-out war on Canadian property investors. Governments and self-proclaimed "experts" are treating investors like they're the reason your kid can't afford a treehouse in Toronto, let alone a condo. Investors are convenient villains, pilloried for driving up prices and scapegoated

Canadian Real Estate Investors Under Siege: Editorial

It's an all-out war on Canadian property investors. Governments and self-proclaimed "experts" are treating investors like they're the reason your kid can't afford a treehouse in Toronto, let alone a condo.

Investors are convenient villains, pilloried for driving up prices and scapegoated for housing and immigration policy failings.

Here's just a taste of the anti-investor sentiment in Canada and the damaging repercussions of federal and provincial governments' short-sighted crusade.

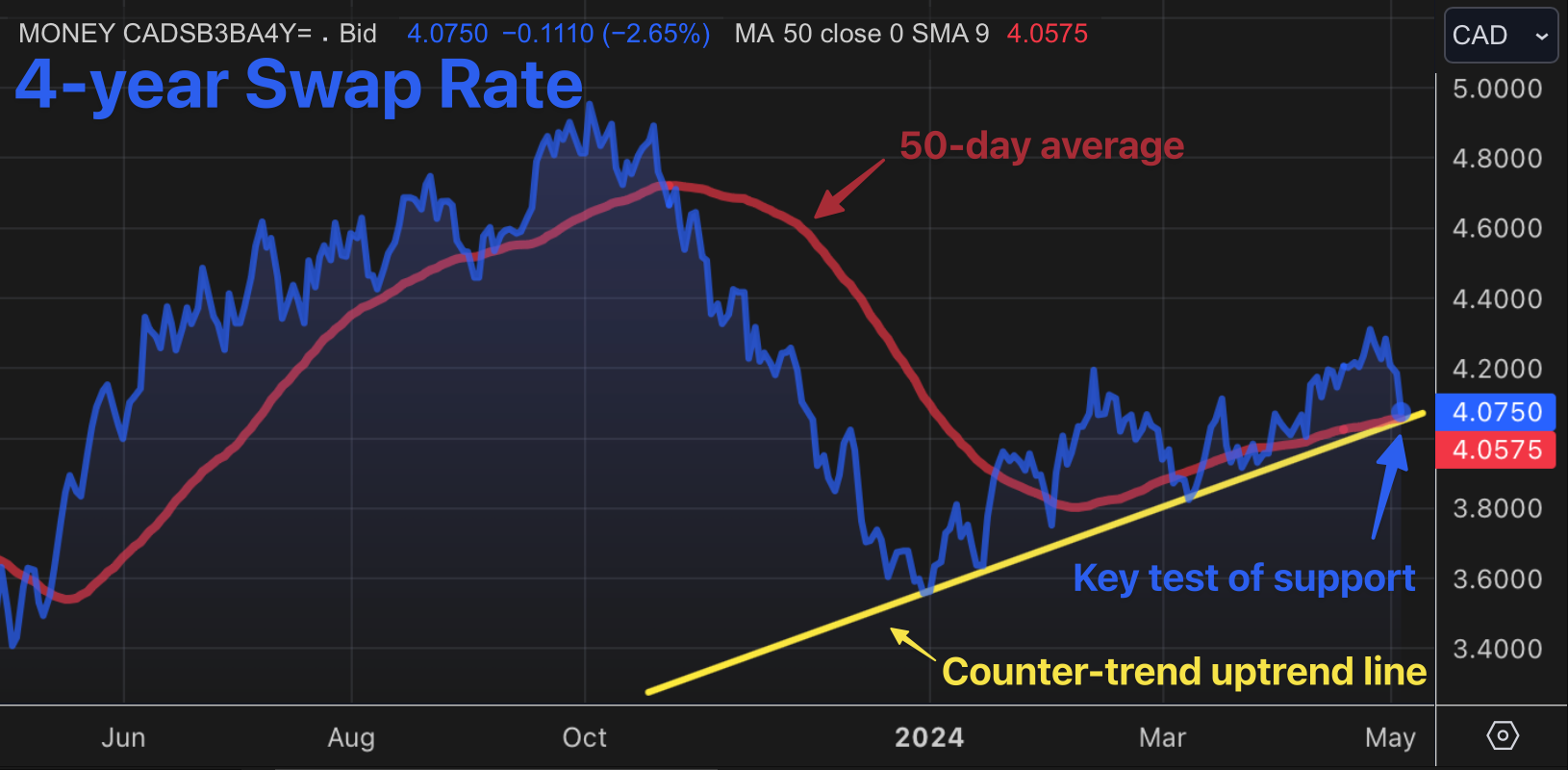

Friday's U.S. jobs report came in so tame it could've been a house pet. Rate markets cheered, BoC rate cut chances improved, and MLN's go-to fixed-rate indicator, the 4-year swap rate, dove 9 bps. Most North American yields now sit near critical technical

BoC Cut Incoming, Market Projects

Friday's U.S. jobs report came in so tame it could've been a house pet. Rate markets cheered, BoC rate cut chances improved, and MLN's go-to fixed-rate indicator, the 4-year swap rate, dove 9 bps.

Most North American yields now sit near critical technical support levels after last week's rate surge turned out to be all bark, no bite.

Back to top🔔The latest rate simulator is live with updated forward rates (download) It's increasingly looking like Canada's first rate cut is teed up for June 5 or July 24. But borrowers would be a lot more confident of that if it weren't for the U.

A Dovish Powell Takes Pressure Off Canadian Mortgage Rates

It's increasingly looking like Canada's first rate cut is teed up for June 5 or July 24. But borrowers would be a lot more confident of that if it weren't for the U.S. timetable being pushed back.

Based on the latest Fed powwow on Wednesday, the key stars-and-stripes interest rate is likely to remain at its 23-year peak of 5.50%—at least through the summer.

On a positive note, the Fed did reassure us that further U.S. rate hikes are off the table for now. Despite bubbly growth, employment and inflation south of the border, Fed Chair Powell chose to relieve markets with a dovish spiel—one that can be summarized in these two quotes:

Back to topNow, here's something that'll get mortgage shoppers' juices flowing. TD has slashed its discounted variable rates. And not just a little.

TD Drops the Gloves on Variable Rates

Now, here's something that'll get mortgage shoppers' juices flowing.

TD has slashed its discounted variable rates. And not just a little.

Back to topFor Alana Riley, Head of Mortgage, Insurance and Banking at IG Wealth Management, getting people into a mortgage that builds their net worth is not only her passion, it's her job. She oversees a team tasked with doing just that, so we thought a quick chat might be

Mortgages Belong in a Financial Plan: Riley

For Alana Riley, Head of Mortgage, Insurance and Banking at IG Wealth Management, getting people into a mortgage that builds their net worth is not only her passion, it's her job.

She oversees a team tasked with doing just that, so we thought a quick chat might be informative. When we spoke last week, she filled us in on how IG now approaches mortgages. We also got the latest on the firm's nesto partnership.

Back to top