• Mortgage Command Centre Upgrades

• Mortgage Bytes

Like every other broker lender, Marathon Mortgage already had business development managers. But that wasn't enough, so it decided to launch a "Broker Concierge" this week.

Back to top📰Also in this edition... • Mortgage Command Centre Upgrades • Mortgage Bytes Like every other broker lender, Marathon Mortgage already had business development managers. But that wasn't enough, so it decided to launch a "Broker Concierge" this week.

Like every other broker lender, Marathon Mortgage already had business development managers. But that wasn't enough, so it decided to launch a "Broker Concierge" this week.

Back to topThe government is on a mission to help renters get more credit. It plans to do that by incorporating rental payments into credit reports. They say the move will help more renters qualify for mortgages. But there are several other implications, and this won't be an overnight Cinderella

The government is on a mission to help renters get more credit. It plans to do that by incorporating rental payments into credit reports.

They say the move will help more renters qualify for mortgages. But there are several other implications, and this won't be an overnight Cinderella story. We're told it could be a long haul from Ottawa's announcement to real-world widespread results.

MLN spoke with Sue Hutchison, President and CEO of Canada's largest credit bureau (Equifax Canada), for a sneak peek at how this change could play out.

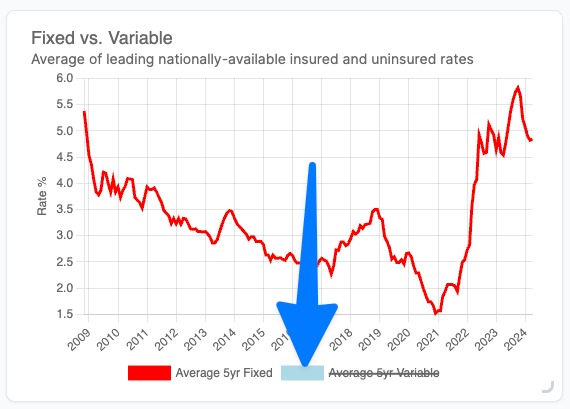

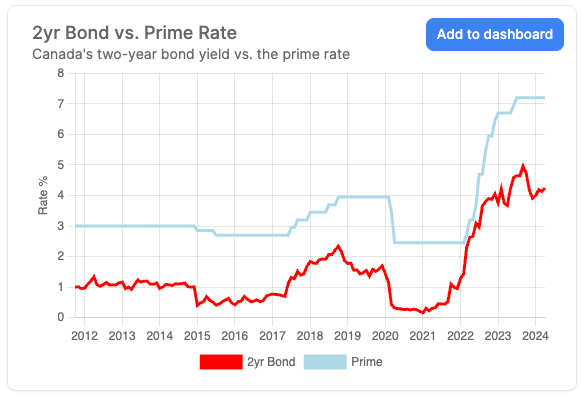

Back to topMLN is thrilled to unveil the beta premiere of our most exciting tool yet: Mortgage Command Centre (MCC). The Mortgage Command Centre is a pilot's cockpit for anyone navigating Canada's mortgage market. Use it to quickly monitor rates, housing, and economic trends, and create data-based content

MLN is thrilled to unveil the beta premiere of our most exciting tool yet: Mortgage Command Centre (MCC).

The Mortgage Command Centre is a pilot's cockpit for anyone navigating Canada's mortgage market. Use it to quickly monitor rates, housing, and economic trends, and create data-based content that wows clients and referral sources.

MLN Pro members now have the superpower ability to:

Watch multiple indicators for trends that may persist. Get a better sense of where rates or housing are going—beyond just the short term.

MLN Pro members are free to copy the MLN charts for personal use or use in customer emails, public-facing content, social media or marketing. Sharing charts and data is subject only to attribution and the reasonable limitations below.

Pro tip: Click on a legend value to hide that data in the chart.

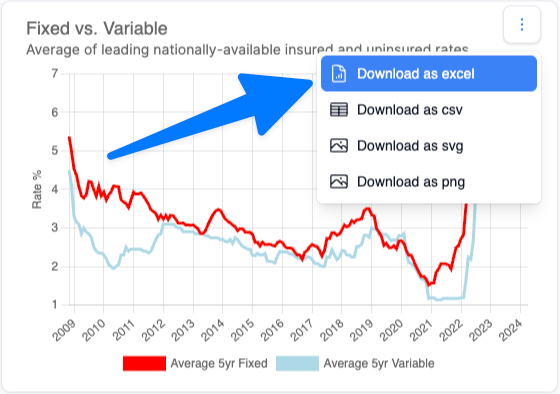

MLN Pro members can click the three dots and download MLN data for personal use (e.g., in their own charts or analysis).

Note: Third-party data (that which is attributed to a source) may not be used without that source's direct permission.

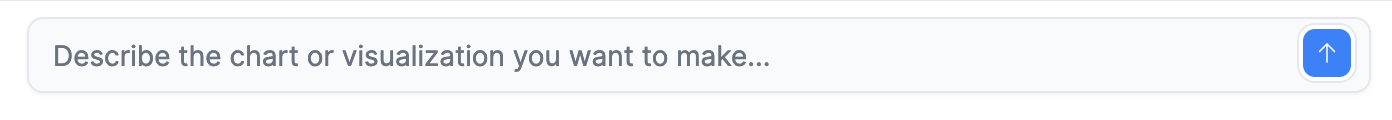

What if you want a chart that doesn't exist?

Ask the AI to create it!

For example, in this box...

...try copying and pasting these instructions, for example:

It should build you a chart that looks like this, which you can copy or download data from.

Pro tip: The AI requires precise instructions to generate charts. The above bullets can be used as a template. Here are all the fields we have data on.

Since this is a beta, any feedback, good, bad, or ugly, is much appreciated. Among the many things we're working on are adding more Bank of Canada metrics and creating the ability to customize your own dashboard.

Today, MLN is unboxing MCC phase I. But many more data goodies are still to be unwrapped, so stay tuned.

The goal of this tool is to give you an ace up your sleeve for trend-spotting and generating applause-worthy insights.

In the meantime, if there's a critical national stat or graph you can't live without, shoot us a message in the comments below. We might be able to whip it up. Odds are, it's on our to-do list anyhow.

Back to topA year ago, we lost Wayne Strandlund, an alternative mortgage innovator and one of the finest men I've met over my 17 years in the mortgage business. MLN doesn't do many remembrance stories, but Wayne deserves remembering because of what his life teaches. Here is his

A year ago, we lost Wayne Strandlund, an alternative mortgage innovator and one of the finest men I've met over my 17 years in the mortgage business. MLN doesn't do many remembrance stories, but Wayne deserves remembering because of what his life teaches. Here is his story.

It doesn't do Wayne Strandlund justice to call him a shrewd businessman and trailblazer in Canada's mortgage industry. His business methods reflected a commitment to his customers and investors that went well beyond the norm.

Wayne's journey began humbly as a farm boy in Saskatchewan. His path led him to Victoria, B.C., where he established himself as a realtor in 1968 and a mortgage broker in the 1970s, long before these professions reached their heydeys.

As a mortgage broker, he saw the need for alternative lending, so he founded a tiny boutique lender. That modest private financing venture would later become one of Canada's most respected mortgage investment corporations (MICs), Victoria-based Fisgard Asset Management.

Through his 50 years of stewardship, Fisgard grew to become a $272 million MIC. Wayne ensured it never lost money for its investors, even in the hard times of 2010/11 when more than 1 in 10 of its mortgages were in arrears. He refused to take management fees for three years after the financial crisis to ensure his investors got sufficient returns.

"He just said, 'You know what? We wrote these mortgages, and our investors shouldn’t suffer',” recalls his daughter Hali Noble, a managing director at Fisgard and former Mortgage Professionals Canada Chair.

For a man like Wayne, it was more important that investors retain their trust in Fisgard than to make more money. Reputation superseded everything else, he felt, because you could never get it back if you lost it.

His dedication to the business was almost mythical. “He always put the investors first, ahead of himself and sometimes even ahead of family,” Hali recalls. And Wayne didn’t rest on his accomplishments, preferring to work hard until the end and protect what he built for the next generation.

“The business was ours to lose,” he often said, and service was a passion. "He wanted us three deep in every position at the company,” Hali explains. The reason was simple: Wayne felt turnaround times were core to customer satisfaction.

Approval and closing efficiency were vital to him for two reasons. One, over 90% of Fisgard's loans were—and are—sourced through mortgage brokers, who need prompt solutions to maintain their reputations with clients. And two, as a former broker, he understood what quick response times mean to end borrowers nervous about the financing process.

Wayne's lending philosophy was simple. Lend against high-quality, marketable real estate with a big enough equity buffer to protect the fund. “He would say, ‘Hali, would you be happy to own this place nine months from now?" she remembers. "What about our investors? Would they want to own it?’”

He thought about every deal from that perspective first. It was “always about the real estate.”

Wayne’s bigger-picture view was that real estate can’t lose long term. “I don't care what you do; just be part of the dirt,” he told his kids. "Everyone needs a place to live, and as long as your fingers are in the dirt, you'll always have opportunity.”

In 1981, Hali—then 11—recalls her father building a hotel in Fort St. John. The project flopped, and Wayne lost almost everything. He owed $1.8 million to investors and had no way to repay it. Instead of declaring bankruptcy like many other lenders during this era of 20%+ rates, the family moved into his mother’s basement. He lived there for six years until he could pay back every cent of that loss to investors.

That was the code of honour Wayne lived by, and “Some of those investors are still with us to this day,” Hali notes.

Over almost half a century, Wayne ensured his company never defaulted on a single distribution to shareholders. Nor did he ever decline a routine redemption request from investors, even when the market bottom was falling out.

Wayne was an enthusiastic mentor who loved to write and share knowledge—case in point: this checklist I've referred to over the years which helps would-be investors size up a MIC.

He also wasted no opportunity to educate people on the business, and this author owes much of his MIC knowledge to him and our discussions over the years.

Another example of Wayne's education focus was starting the “Supersaver” program. It was created to help kids understand compound interest. They'd receive a 5-year investment in Fisgard and could log in and watch their investment grow over time.

And then came Wayne's legendary community involvement, which is far too great to list here (see this list). It ranged from Chancellor of Royal Roads University to supporting the Victoria Symphony, fighting for indigenous groups, and establishing scholarships for Matis students. Wayne supported arts and culture and countless sports teams in Victoria. A notorious benefactor, Wayne donated millions, reportedly departing this world with only $60,000 in his bank accounts. Everything else he invested in his family or donated.

Wayne was a man who believed in keeping his word, and not just 99% of the time. 100% of the time. He felt that being someone you could always count on and living life above board would always pay off in the end.

Today, Fisgard is still a family business run by his three kids, Hali, Jason, and Rafer. To know them is to know that their dad's straight-shooting approach to life and business rubbed off.

Wayne Strandlund devoted his energy and resources to improving the lives of borrowers, investors, partners, family and people who never even knew him. In the process, he elevated Canada’s non-institutional mortgage sector to a new level. As Hali put it, “He believed that good karma all comes back to you in life.” And he wanted to end on the positive side of that ledger.

Back to topThis is not the pattern we like to see in Canada's 5-year bond. "Cup and handle" patterns like this tend to break out and follow through about two-thirds of the time. If that happens here, it projects the yield rising to roughly 4.20%—calculated by

This is not the pattern we like to see in Canada's 5-year bond.

"Cup and handle" patterns like this tend to break out and follow through about two-thirds of the time.

If that happens here, it projects the yield rising to roughly 4.20%—calculated by flipping the "cup's" low point (~3.40%) above the breakout point. That still wouldn't be a new cycle high, but it's enough to kick fixed rates up by 25+ bps. It would also put our 5-year yield's 4.46% cycle high within reach.

Lord willing, and the creek don't rise, this time will mark the 1 in 3 times when this pattern fails. But one can't bet on it, which means mortgage shoppers can't take rate holds for granted.

For now, we're keeping our peepers on Middle East developments, and next week's retail sales and U.S. core PCE inflation, looking for a ray of sunshine.

One of Canada's top direct-to-consumer (DTC) mortgage providers is now officially open for business for M3 Group mortgage brokers — in all 10 provinces. Boasting $11 billion of mortgages under administration, Nesto claims its recipe – a dash of competitive rates, a sprinkle of speed, and a heap of simplicity

One of Canada's top direct-to-consumer (DTC) mortgage providers is now officially open for business for M3 Group mortgage brokers — in all 10 provinces.

Boasting $11 billion of mortgages under administration, Nesto claims its recipe – a dash of competitive rates, a sprinkle of speed, and a heap of simplicity – is the secret to its sauce.

We caught up with the co-founders, CEO Malik Yacoubi and Principal Broker Chase Belair, to get the lowdown on whether their entrée's worth tasting. The short answer is, depending on the client's needs, nesto's rates at the time and the rates a broker has access to elsewhere, it may well be.

Here's a cheat sheet for all its broker benefits, rates and products...

Back to topIt's a dark day for successful Canadian investors, seven-plus-figure entrepreneurs, and even mom-and-pops with their appreciated cottages. Our friends in Ottawa are cranking up the capital gains tax to fuel their latest splurge—$39 billion in net new spending and $39 billion of red ink annually for the

It's a dark day for successful Canadian investors, seven-plus-figure entrepreneurs, and even mom-and-pops with their appreciated cottages.

Our friends in Ottawa are cranking up the capital gains tax to fuel their latest splurge—$39 billion in net new spending and $39 billion of red ink annually for the next two years.

Effective June 25, Uncle Justin will tax two-thirds of your capital gains versus one-half today. This starts at dollar one for corporations and trusts, but the new 2/3 inclusion rate applies only to capital appreciation over $250,000 for individuals. It's the first change to capital gains inclusion since dial-up internet was a thing, 23 years ago.

Canada's rate market needed a win like this, and it got it. #Average core inflation# has delivered again. For the first time since the seemingly ancient days of mid-2021, it starts with a "2." Today's welcomed report read as follows: * Headline inflation: 2.9%

Canada's rate market needed a win like this, and it got it. #Average core inflation# has delivered again. For the first time since the seemingly ancient days of mid-2021, it starts with a "2."

Today's welcomed report read as follows:

This is what the Bank of Canada wanted last week when it said, "Governing Council is particularly watching the evolution of core inflation..." And believe us, the BoC hasn't just been watching core—they've been holding their collective breath, and now, they can partially exhale.

Back to topIt's been one of the most action-packed weeks for Canadian housing policy in years. But before we unwrap that, let's talk about what's expected to be a volatile week for rates—following Iran's attack on Israel.

It's been one of the most action-packed weeks for Canadian housing policy in years. But before we unwrap that, let's talk about what's expected to be a volatile week for rates—following Iran's attack on Israel.

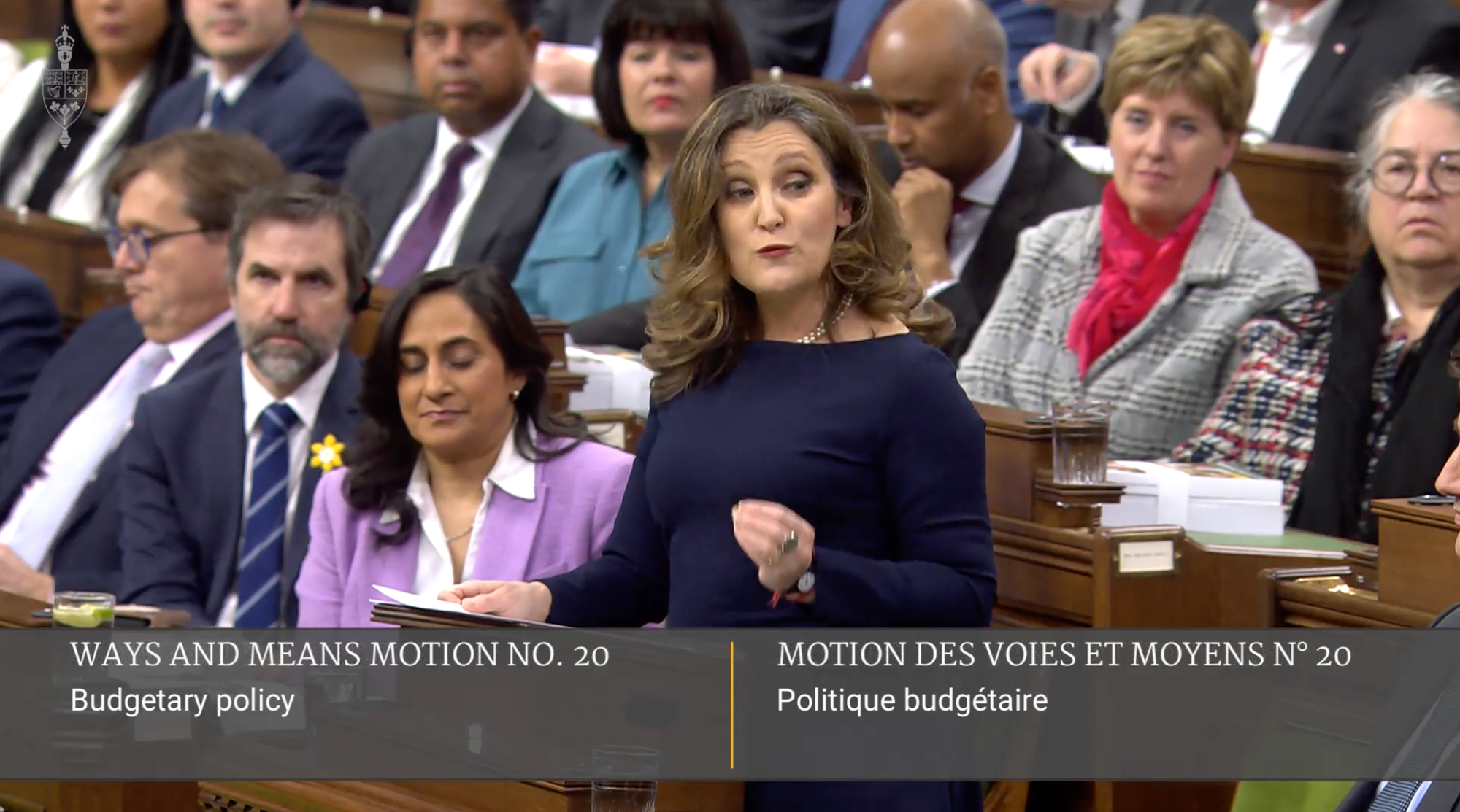

Back to topAs MLN hinted last Thursday, insured 30-year amortizations are coming back from the dead after a 12-year absence—with a few strings attached. Finance Minister Chrystia Freeland made the announcement today and the change takes effect August 1. Insured extended amortizations will be available to first-time buyers purchasing new construction

As MLN hinted last Thursday, insured 30-year amortizations are coming back from the dead after a 12-year absence—with a few strings attached.

Finance Minister Chrystia Freeland made the announcement today and the change takes effect August 1. Insured extended amortizations will be available to first-time buyers purchasing new construction only.

There's no word yet on what insurance premium surcharges will apply. Nor do we know what exactly constitutes "new construction." CMHC didn't have an answer when we asked them today, but we'd guess it's any unsold/never-occupied, pre-construction or existing, single- or multi-unit home.

A Finance Department official told MLN, "Before finalizing details around eligibility, mortgage insurers—including CMHC—need to have conversations with mortgage lenders ... So, in the near future, we will make sure younger Canadians know exactly what types of new builds qualify for the 30-year amortization."

The BoC left its target rate anchored at 5% this morning, but hold the phone—it just got upstaged — by U.S. inflation. America's reaccelerating CPI data stole the show this morning, sending bond traders into a bearish frenzy. The BoC left the beacon on for 2024 rate

The BoC left its target rate anchored at 5% this morning, but hold the phone—it just got upstaged — by U.S. inflation.

America's reaccelerating CPI data stole the show this morning, sending bond traders into a bearish frenzy.

The BoC left the beacon on for 2024 rate cuts, however, despite keeping its lips zipped on the U.S. inflation letdown. Here's what mortgage hunters need to know in case the rate waters get rough.

Back to top