Almost three-quarters (73%) of Canadians think home ownership is the best investment they can make, says a RE/MAX poll.

The other quarter might be too busy searching for that mythical "affordable rental" to answer.

A separate Royal LePage survey shows 56% of house hunters have put their purchase plans on ice, thanks to pesky rising interest rates. Half of these paused buyers say they'll get back in the game if (when?) rates take a dip.

Knowing that this is the prevailing psychology and that:

- inventories remain tight

- the government's supply fix is slower than molasses

- the stream of new Canadians remains non-stop

- risk assets are pricing in a "0% chance of recession," per Economist David Rosenberg...

...it takes a bold economist to predict materially falling home prices.

Those economists who do must be clairvoyant and see a future where mortgage rates make new cycle highs, joblessness skyrockets or immigration targets get slashed.

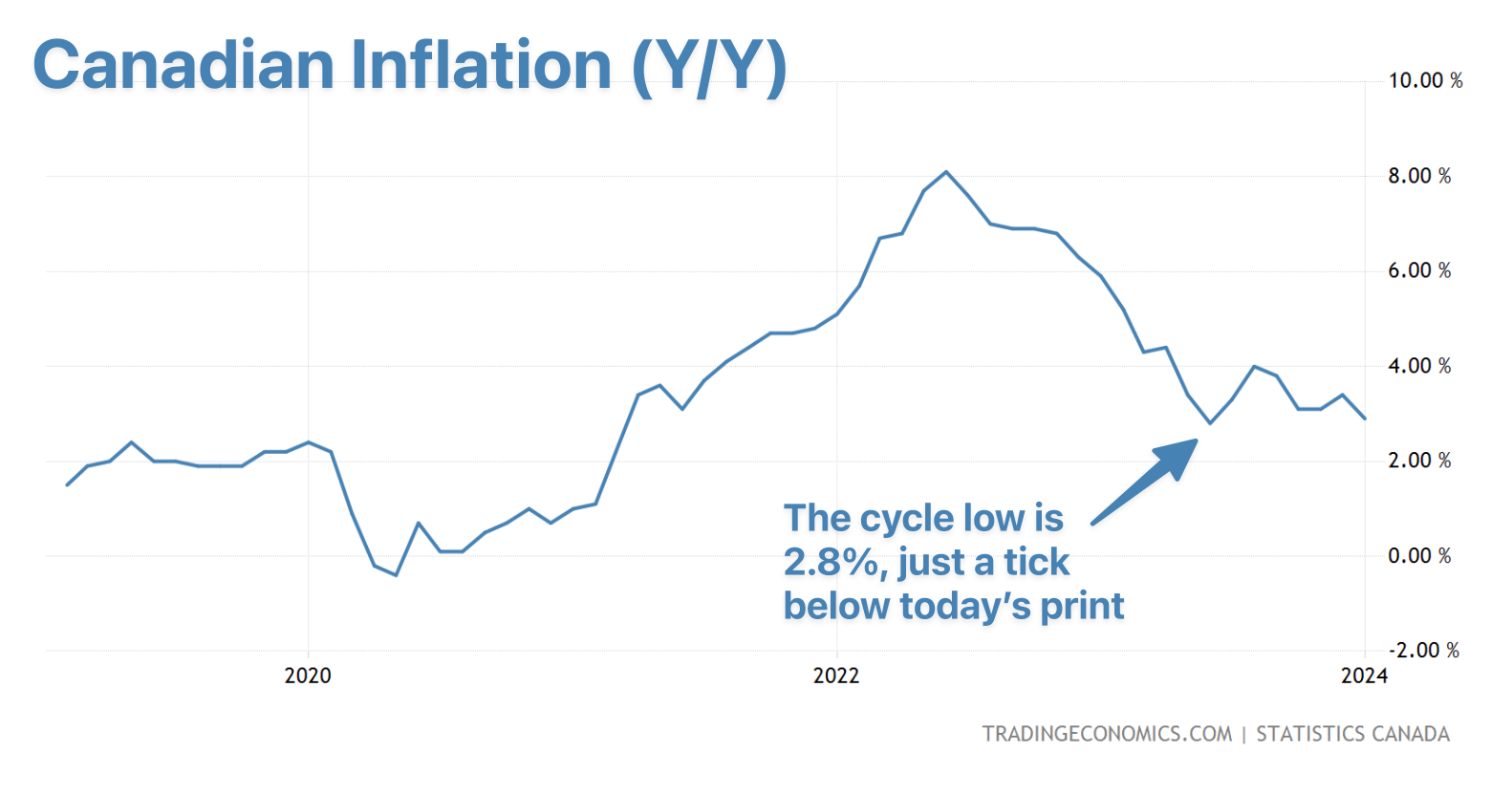

Short of such wild cards, it's hard to conjure up realistic scenarios for significantly falling values. If inflation drops to target in the next 6 to 12 months, this spring might be a golden, blink-and-you'll-miss-it, window to snag a home near today's price tags.

"Buy today or pray"

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top