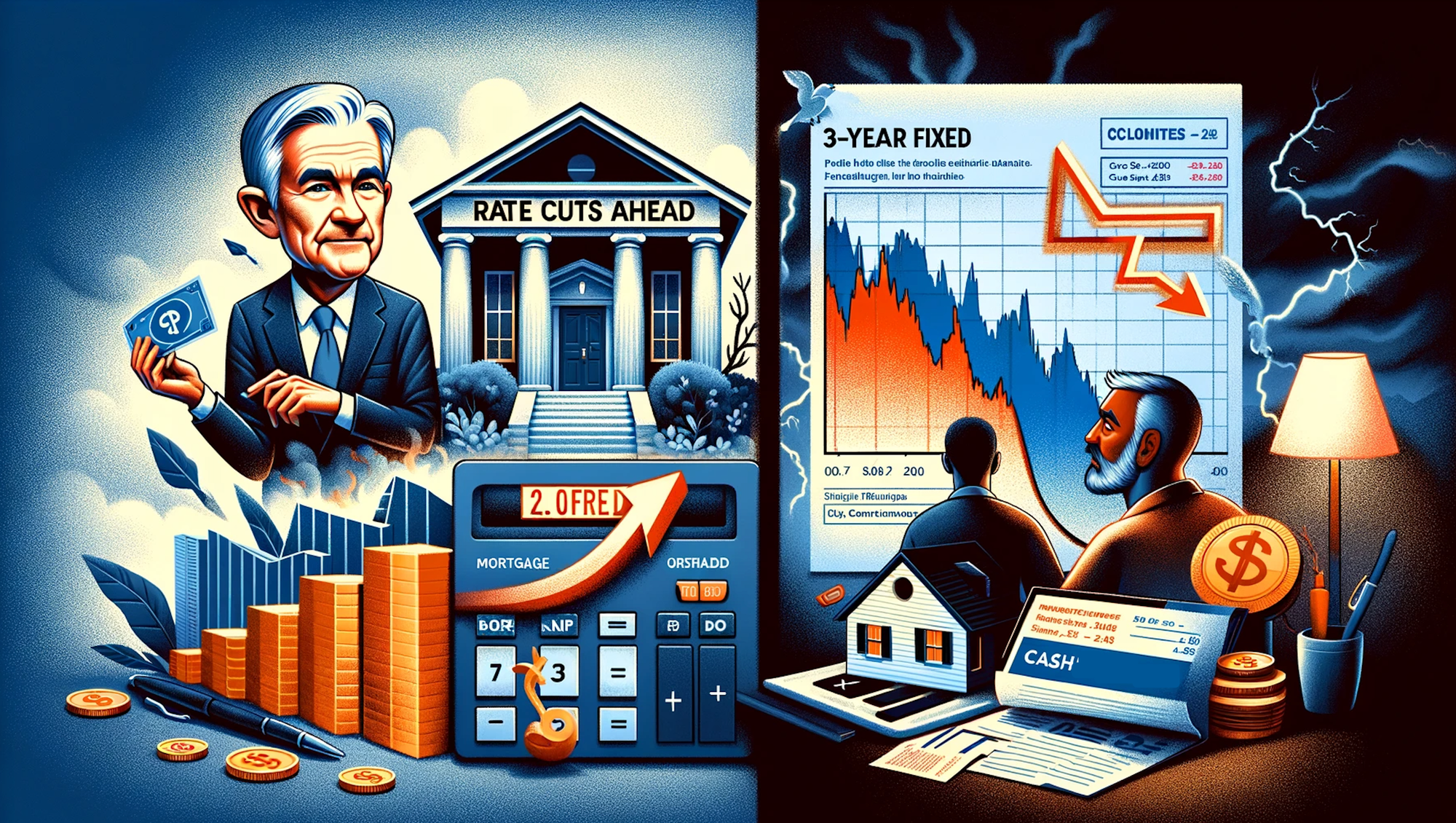

The Bank of Canada didn't just put rate hikes on the back burner today; it unplugged the stove.

The Bank is now "confident enough" that inflation is on the right track to not publicly dwell on rate hike risk any longer. That was today's message from Senior Deputy Governor Carolyn Rogers after the BoC left its overnight rate at 5%.

Instead, the Bank says it's now shifting its focus to "how long" the overnight rate needs to marinate "at the current level.”

"We need to give these higher interest rates time to do their work," Macklem said, offering no clues on how long he'll let Canada's high-rate stew simmer. The forward market thinks it'll take another four to six months. But, historically, rates have plateaued at peak levels for anywhere from a few months to 17 months. So far, it's been six months since the last hike.

The Bank says that higher rates can't be completely ruled out, but it's very rare for the Bank of Canada to hike a lot, pause 5+ months, hike more, pause 5+ months more, and then hike again.

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top