💡

Reader note: Stay tuned for tomorrow's MLN exclusive with Scotiabank's new mortgage head, Tracy Gomes. She outlines the bank's broker and digital mortgage plans for 2024.

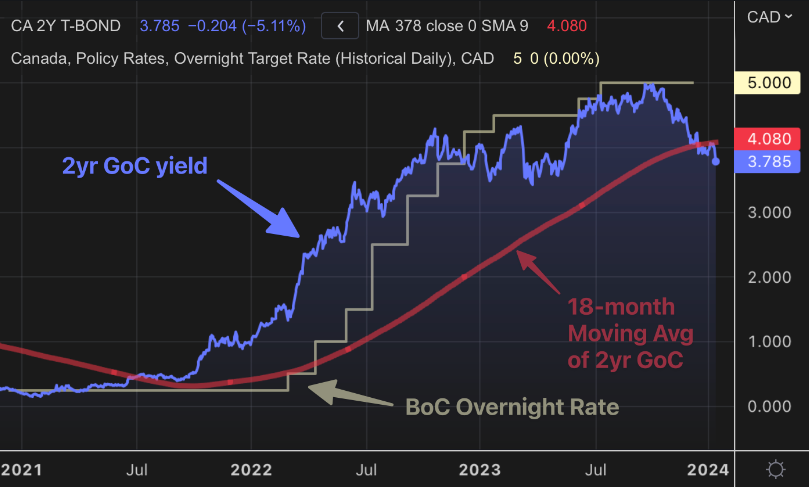

The Bank of Canada is feeling tension after Tuesday's frustrating inflation data. But economists never expected great things from this report to begin with. Inflation's acceleration last month was as foreseeable as sunrise, mainly because the year-ago comparable was so unfavourable.

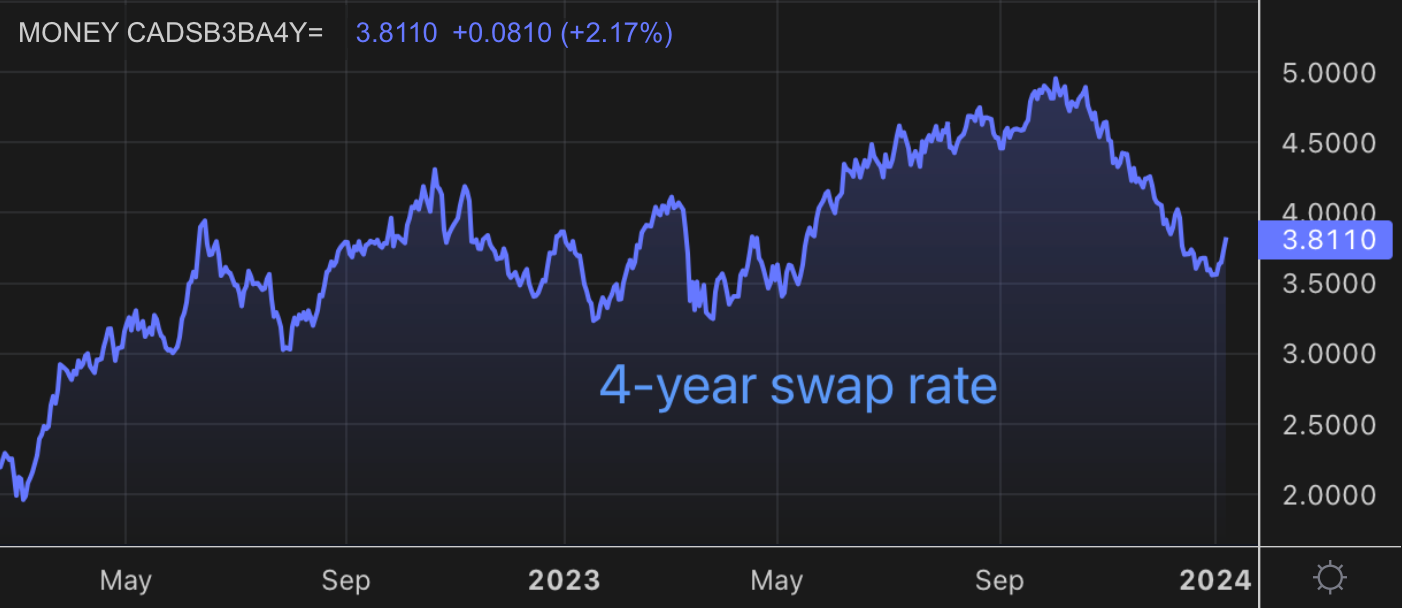

It's what happens this quarter that really matters. And now it gets real because Canadian and U.S. headline inflation have made no progress for six months. Moreover, challenging #base effects# are out of the way and can no longer be used as a scapegoat.

If the BoC doesn't get what it wants in the next few reports, we may shift from speculating about rate reductions to having a heart-to-heart on hikes. But that's not the mainstream expectation, so we might as well stay optimistic.

Before getting into the devilish details, here are today's latest readings:

- Headline inflation: + 3.4% (v.s 3.1% last month and 3.4% consensus)

- Avg. core inflation: +3.73% (vs. 3.67%, and up a disappointing 0.4% m/m)

Commentators blamed those aforementioned base effects for the uptick in the headline number, with gasoline prices playing a pivotal role—an inflation phenomenon felt globally, not just in Canada.

The real head-turners for the Bank were the two core measures. Markets expected them to slow. Instead, they not only rose, but prior months were revised higher. And note, "These are central tendency inflation measures totally unaffected by outlier price changes like mortgage interest," reminds Scotiabank Economics economist Derek Holt.

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top