MLN Alerts

MLN Stream

It took little time for True North Mortgage to scoop up 25+ former Rocket Mortgage Canada employees. The move turbocharges the Calgary-based company's salesforce and follows Rocket Canada's announced closure. "True North Mortgage is pleased to provide employment opportunities to nearly two-thirds of Rocket Mortgage

True North Acquires Rocket's Staff in Major Growth Push

It took little time for True North Mortgage to scoop up 25+ former Rocket Mortgage Canada employees. The move turbocharges the Calgary-based company's salesforce and follows Rocket Canada's announced closure.

"True North Mortgage is pleased to provide employment opportunities to nearly two-thirds of Rocket Mortgage Canada’s front-line mortgage professionals," said Amanda Magee, Chief Growth Officer of True North. "The company will also maintain an office presence in Windsor, Ontario, ensuring continuity for employees and contributing to the local economy." The outpost will function as a remote call centre, like True North's main Calgary and Toronto offices.

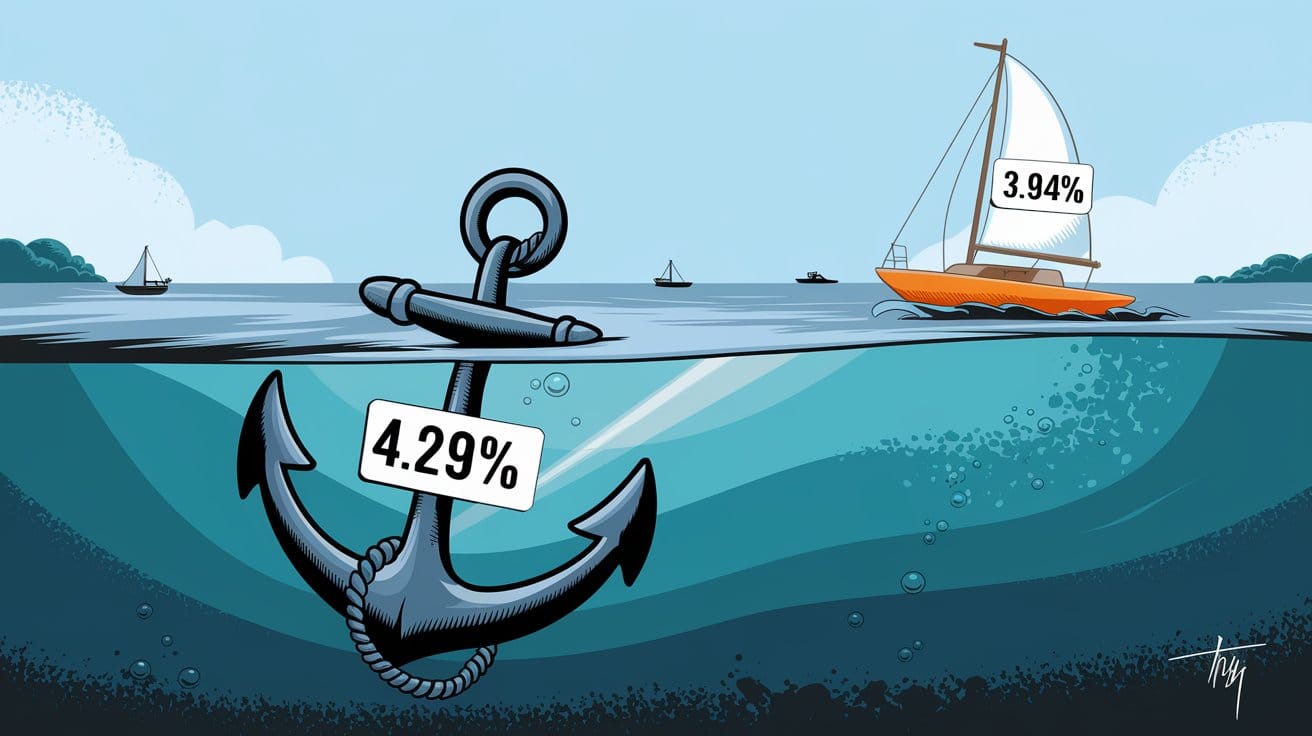

Back to topRate tables on mortgage websites are often as compelling as a parliamentary budget footnote. Far too many sites settle for generic, ineffective rate grids with no context for consumers whatsoever. If yours is one of them, leveraging a technique called price anchoring can boost prospect engagement.

Master the Art of Rate Anchoring

Rate tables on mortgage websites are often as compelling as a parliamentary budget footnote.

Far too many sites settle for generic, ineffective rate grids with no context for consumers whatsoever. If yours is one of them, leveraging a technique called price anchoring can boost prospect engagement.

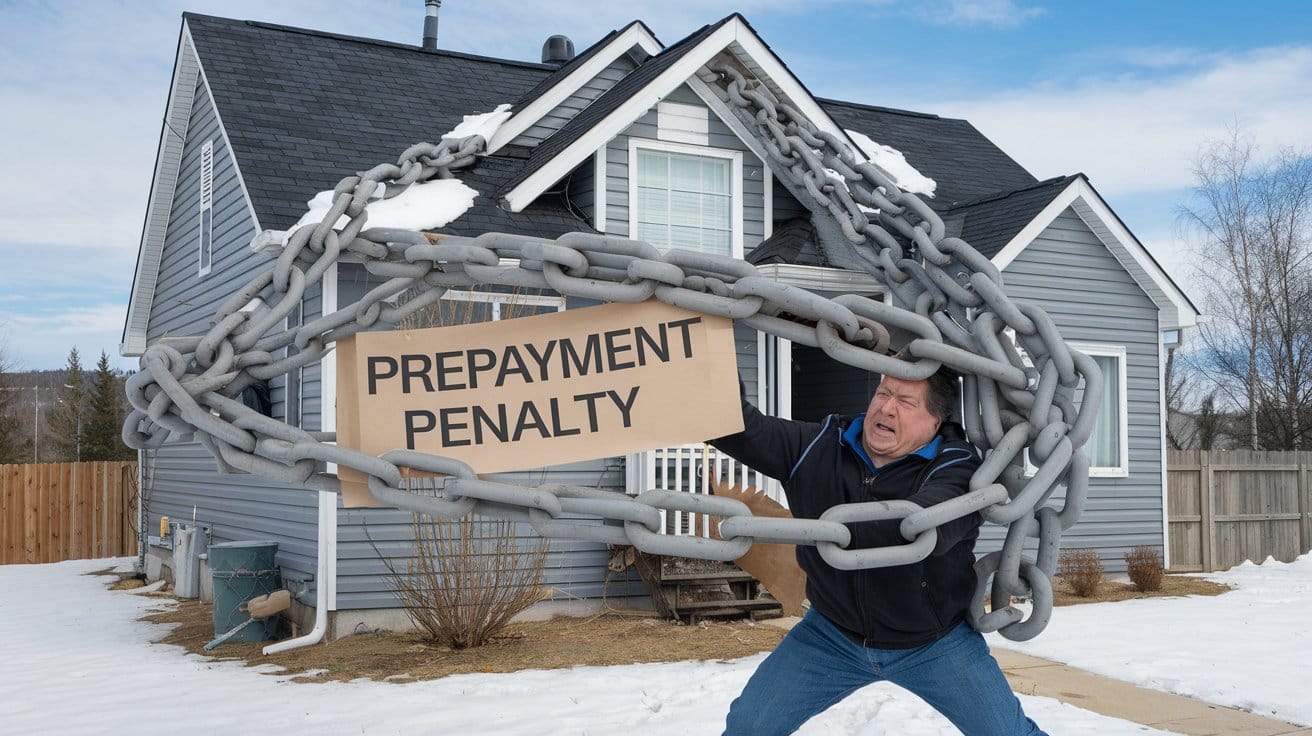

Back to topIf you're seeking a textbook case of banks giving consumers the short end of the stick, look no further. The nation's biggest mortgage lender, RBC, just slashed its posted rates. "RBC's move is the biggest move to increase penalties (IRDs) since its posted

RBC Mortgage Penalties Skyrocket

If you're seeking a textbook case of banks giving consumers the short end of the stick, look no further.

The nation's biggest mortgage lender, RBC, just slashed its posted rates.

"RBC's move is the biggest move to increase penalties (IRDs) since its posted rates peaked on September 20, 2023," says Matt Imhoff, founder of Prepayment Penalty Mentor (PPM).

For those fluent in the dark arts of interest rate differential (IRD) charges, this spells disaster for anyone daring to escape their RBC mortgage shackles early. Here's precisely how grim it gets...

Back to top