The thorn in big banks' side will soon be gone. After a shoddy review by the Competition Bureau, the Finance Minister has given HSBC's merger with RBC the bureaucratic blessing we all saw coming.

HSBC was the one Big 6 challenger with low enough uninsured funding costs and the will to advertise rock-bottom rates. It'll now fade into memory after the deal closes in the next month or so. Most of HSBC's mortgage customers will then be gobbled up by the golden lion, and remaining lenders will rub their hands with glee at the prospect of plumper profit margins.

As for HSBC's broker arm, which often advertised the lowest uninsured rates in the channel, here's what we know—or don't know—so far:

- As of noon today, sources tell us that HSBC has refused to provide clarity to DLC and its brokers regarding the fate of its broker channel. Talk about leaving your "partners" hanging.

- Our management contacts at HSBC said they were required to refer us back to media relations. But HSBC's spokesperson apparently took a vow of silence, saying she had no information to share.

- RBC's media man said he'd offer more details "once we have a clearer picture" of the plan.

If we were Vegas line makers, we'd post the odds at somewhere between nil and zilch that RBC keeps HSBC's broker channel going much past the closing date. We'd love to be wrong on that and understand that Dominion Lending has approached the bank previously to find a way to keep it going. But don't throw your retirement savings on this long shot just yet.

The fate of HSBC's mortgage team post-merger is about as clear as a fogged-up windshield. RBC's gracious "minimum period of six months" employment pledge probably has HSBC staffers hanging by a thread like precarious Christmas ornaments. As for how many will get the corporate version of a lump of coal, that's anyone's guess. Spare a thought for this bunch this holiday season; their yuletide cheer may just come with a side of job hunting.

As for HSBC's mortgage borrowers, which will soon transition to RBC customers, the #DoF# made RBC agree to the following:

- HSBC customers must be able to transfer to RBC with no fees (legal, appraisal or otherwise)

- RBC employees must "proactively and clearly" provide information on "whether special or non-posted rates and other price discretion is available" to each HSBC borrower. In other words, no sticking renewing HSBC borrowers with posted rates! (Not that any bank would dream of such a thing.)

- RBC must advise on "Whether mortgage holders can negotiate the interest rate on the basis of demonstrable offers received by other lenders or through mortgage brokers." Amusing. The DoF felt it needed to have RBC remind borrowers they could negotiate.

This deal will soon be swept under the rug. One can only hope that voters keep a mental sticky note about the day a certain taxpayer-funded agency and Finance Ministry, whose job descriptions included championing the competitive spirit and defending consumer wallets, seemed to take an unplanned sabbatical when duty called.

The Competition Bureau's contradictory report on the merger reads like a paradox wrapped in an enigma. It appears the bureau was all too eager to give its bureaucratic nod of approval—a rubber stamp so enthusiastic, it might've bounced back and hit 'em in the forehead. And they did it using their very own words, no less.

- "HSBC Canada offered market-leading rates."

- HSBC "issued below market rates."

- The RBC deal would "result in a loss of rivalry."

Then, in a punchline framed as a press release, the Finance Minister declared with a straight face: "The proposed acquisition would not lessen competition for mortgage rates."

Low rates are "most frequently driven by competition from Big 5 Banks,” the DoF claimed. Pinocchio would've blushed at that one, as the nose of whoever wrote this fiction probably wouldn't fit out the door.

Our megabanks may fund and close most mortgages, but it's been the scrappy lenders at the margin that advertise the most competitive rates—the majority of the time. HSBC played that game like a champ, with pricing usually 20 to 80+ basis points below advertised Big 6 offers since 2016.

Make no mistake; yours truly has the utmost respect for the operational brilliance of banks and RBC's chess-like finesse in pulling this deal off. No one should blame Royal Bank for the outcome of this deal as it owes a duty to its shareholders first. And the fact is, HSBC Canada wanted out so some kind of deal was inevitable.

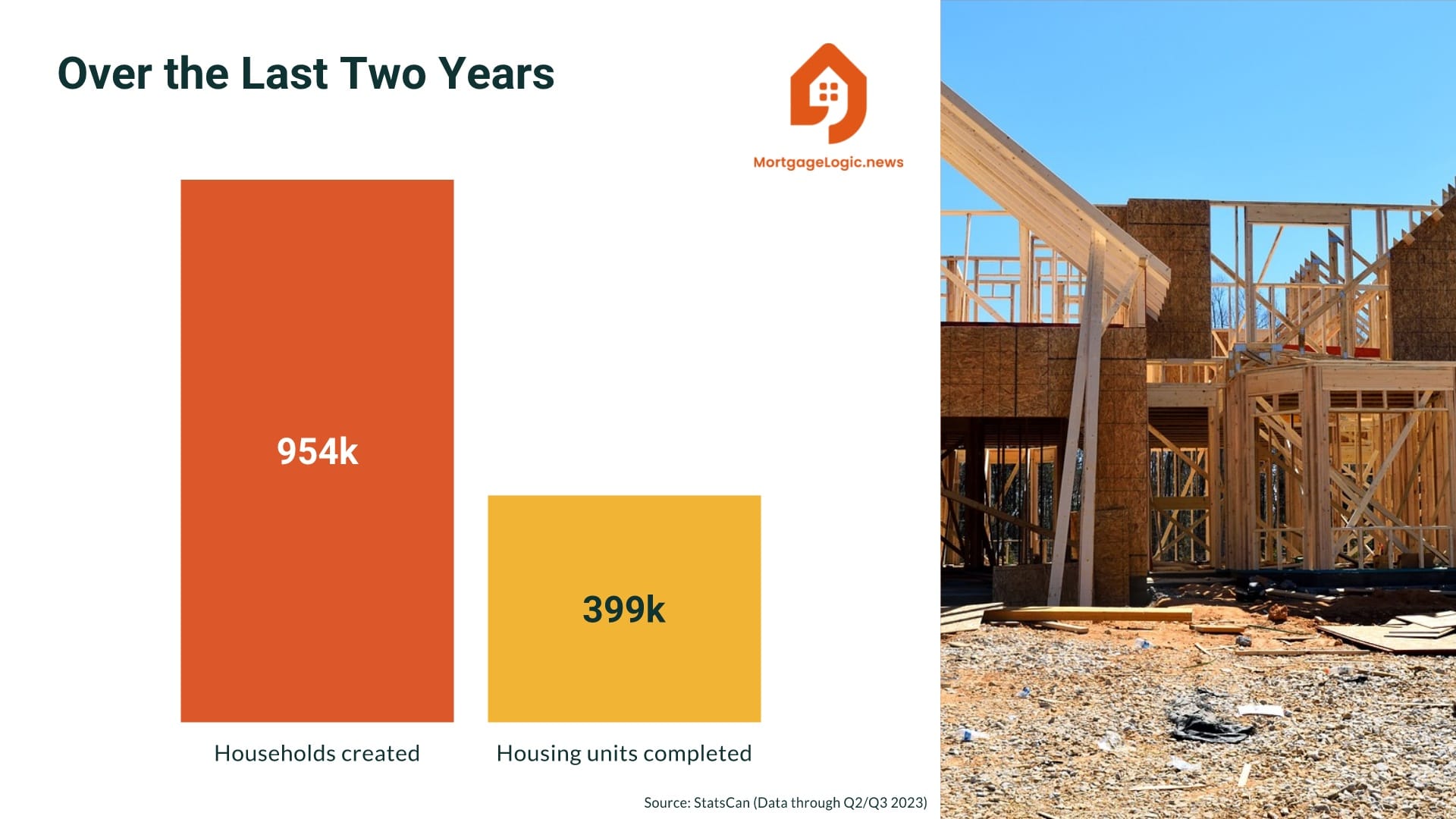

The government could have forced a mortgage spin-off or a sale to a non-Big 6 buyer, but it chose the easy way out. The Competition Bureau—which has never blocked a bank deal—justifies its decision, saying, "HSBC Canada had achieved limited market penetration." Nothing could be more beside the point. HSBC intentionally targeted better-quality borrowers than RBC. So, competition in that segment will now unequivocally decline.

The fact that HSBC had only a 2% market share is not because it didn't have a strong mortgage offering. That 2% share is real-world proof of how hard it is to dislodge the oligopolists from their thrones despite a strong mortgage offering.

The Big 6 banks reign supreme over the uninsured mortgage realm, flexing their capital market muscles, steamrolling competitors with their marketing machines, sprawling their branch networks far and wide, and enjoying VIP access to basement-level funding costs. In Canada, that's a club as exclusive as a table for seven at Sushi Masaki Saito, and out of all prime lending challengers, HSBC was the rare member not just clinging to the edge of the table.

Back to top