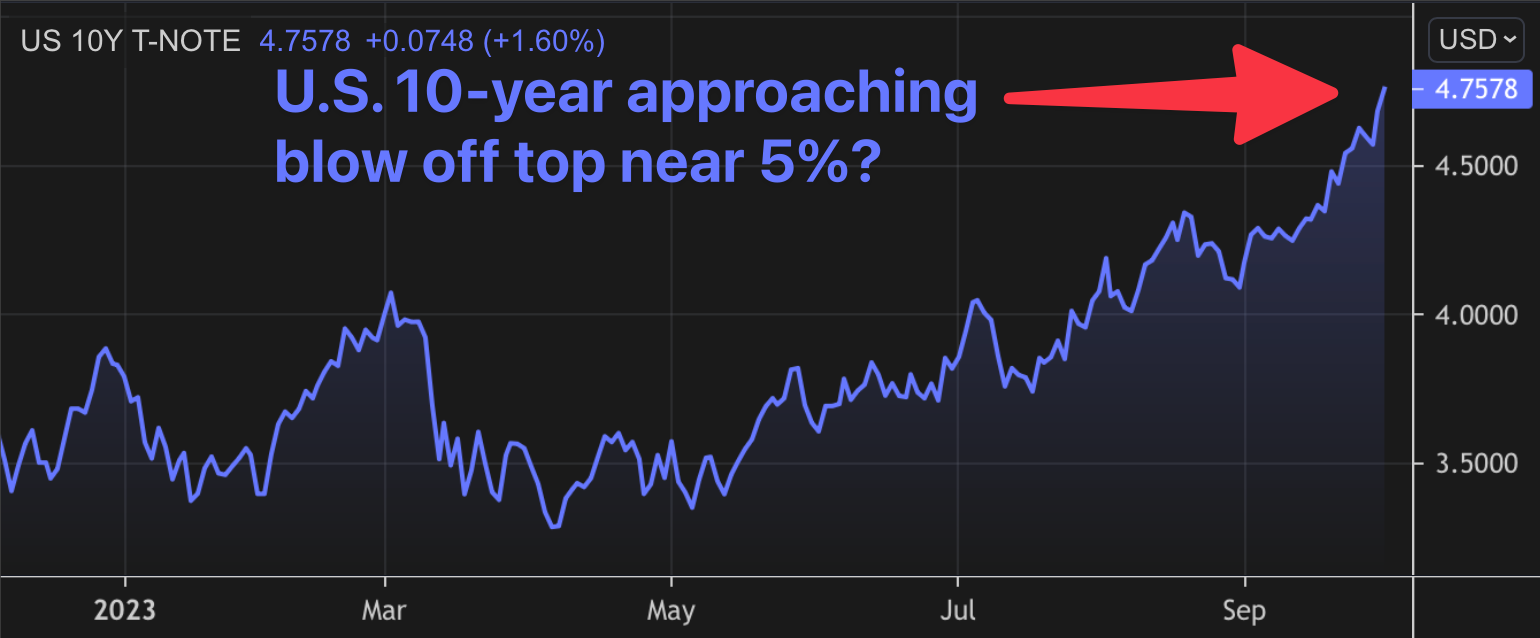

The other day, I heard a bond trader irreverently explain bond market action by coining the acronym: ISS.

a.k.a. "It's supply, stupid."

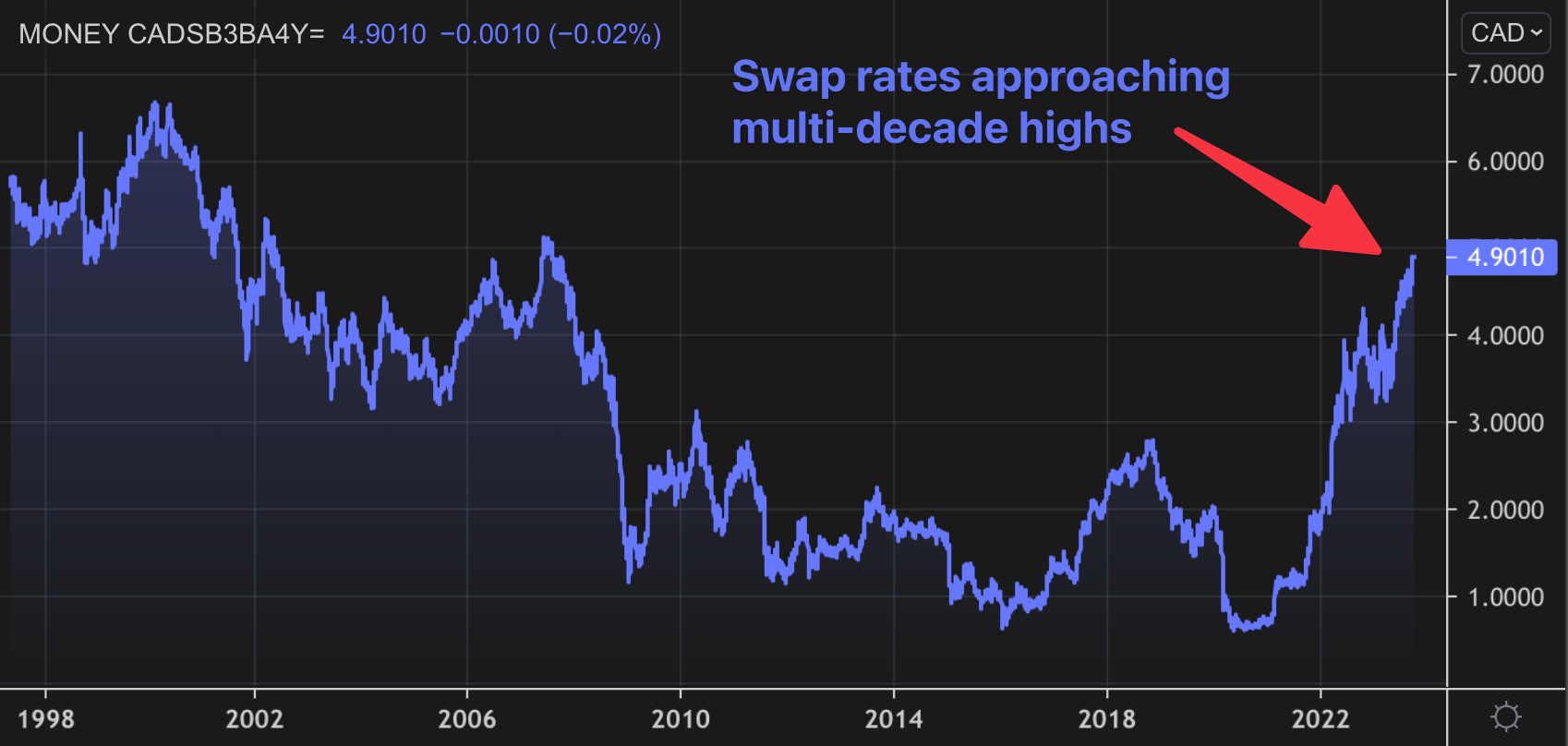

What it means is that bond traders are rapidly recalibrating their rate expectations, given the avalanche of supply hitting the government debt market, and expected to hit it.

Meanwhile, reckless overspending in Washington and Ottawa keeps pouring more gas on the fire—boosting both bond issuance and inflation.

Now, when it comes to when rates will peak, MLN has no crystal ball and Ms. Cleo isn't returning our calls. The Fed is the most qualified to speculate on peak rates, and even it is frequently wrong on timing and magnitude. Witness the continual upward revisions to its very own "dot plot" rate projections.

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top