MLN NewsStream

If you're in the mortgage game—and serious about it—strategy planning for the coming year is an annual ritual. When crafting that plan, it never hurts to compare your outlook with that of big players in the mortgage origination space. And in Canada, they don't get much bigger than DLC Mortgage Group (DLCG).

We caught up with Gary Mauris, CEO of DLCG, who's been steering DLC's ship around the interest rate tsunami and housing storm. He gave us the lowdown on his team's 2024 mortgage expectations...

Rate Party Extends a Second Day

Fed chair Powell is like the James Bond of central banking – licensed to thrill.

And did he ever. The Fed banker with the golden gun started the rate festivities early this week, leaving mortgage originators feeling like they just hit the jackpot.

The 2-year #GoC# yield—which often front-runs BoC policy changes—dove with U.S. rates. It's now below its 18-month moving average (MA) for the first time since 2021 (chart below)....

Mortgage Market Could Get Its Mojo Back as Powell Pivots

📰Canadian 5-year yields hit half-year lows following Fed announcement.

It was a bombshell down in Washington D.C. today. The U.S. Federal Reserve has just signalled that liquidity will return to the mortgage market in 2024.

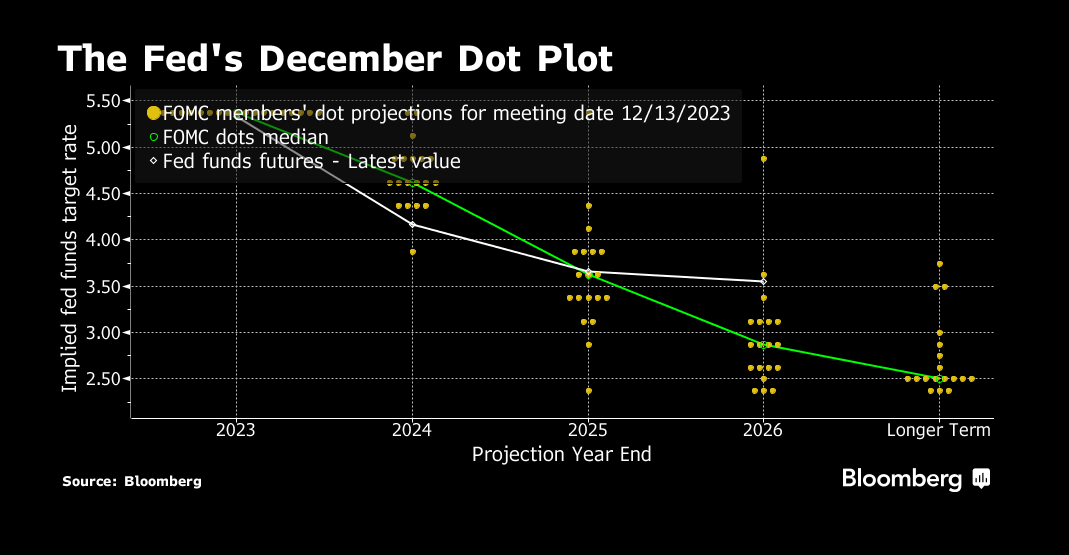

In a policy swivel that few saw coming, Fed chief Jerome Powell confirmed the Fed has already begun discussing when to "dial back" rate hikes—not that they will in the near future. To markets, that's the Fed effectively endorsing the peak rate thesis.

Canadian yields, mov...

Mortgage Rate Maze: What Next from the Fed?

💡OSFI left its minimum qualifying rate (MQR) at 5.25% on Wednesday. Details below...

Trying to bring inflation back to 2% is starting to feel like trying to lose weight over the holidays—tough sledding.

Wednesday's U.S. CPI report was a reminder of that. Headline inflation ticked down a notch to 3.1% from the previous 3.2%, moving with the urgency of a turtle herd. But core inflation seems to have attachment issues. It's been stuck in the 4.0 to 4.1% range for three months....

Mortgage Pros: 25 Tactics to Catapult a 2024 Comeback

For many in the business, 2023 was to the mortgage sector what pigeons are to statues.

Fortunately, the slate wipes clean in less than a month. With rate relief on the horizon and December volumes as slow as Toronto traffic, there's no better time to strategize on expanding your presence, increasing efficiencies and fortifying your brand.

Here's a hit list of 25 tactics that might do just that. Not every tip will fit, but you'll probably find a couple to build your mortgage muscle in 2024....