MLN NewsStream

Congrats to every financially stable borrower who got a 5-year fixed this month – you are philanthropists who generously donated to your lender's “We Love Your Money” foundation. And be sure to attend the next meeting of the "I Didn't Do the Math" club. It's held regularly at the "Shoulda Got Better Advice" café....

Unpacking Canada's Mortgage Charter: Toothless Tiger or Consumer Champion?

A Department of Finance official confirmed on Friday that the six Canadian Mortgage Charter (CMC) provisions are expectations (she called them "rules") but most won't be regulations.

The official wouldn't commit to saying banks had to follow all six rules, but they are "expected" to.

"This is the government putting in black and white in a fiscal document what Canadians should expect when they are up for renewal," the official said, speaking on background. "And if they feel their banks are not...

Savvy Rental Investors Don't Wait for the All-Clear Signal

You hear it all the time, "Rental properties don't cash flow anymore," like it's some kind of universal truth.

But not every new rental is a money pit waiting to devour your wallet.

For property investors who like to skate to where the puck is headed, it's about seeing opportunities where others see a closed door....

Liberals' Economic Update: A Report Card on its Mortgage Measures

The Liberals served up their Fall Economic Statement (FES) yesterday and it's got multiple ramifications for mortgage borrowers and lenders. We've taken the liberty to grade our trusty rule makers on each of their mortgage-related moves.

The result? A smattering of A's - impressive. But then, as unexpected as finding cheese on a pizza, there's one glaring F....

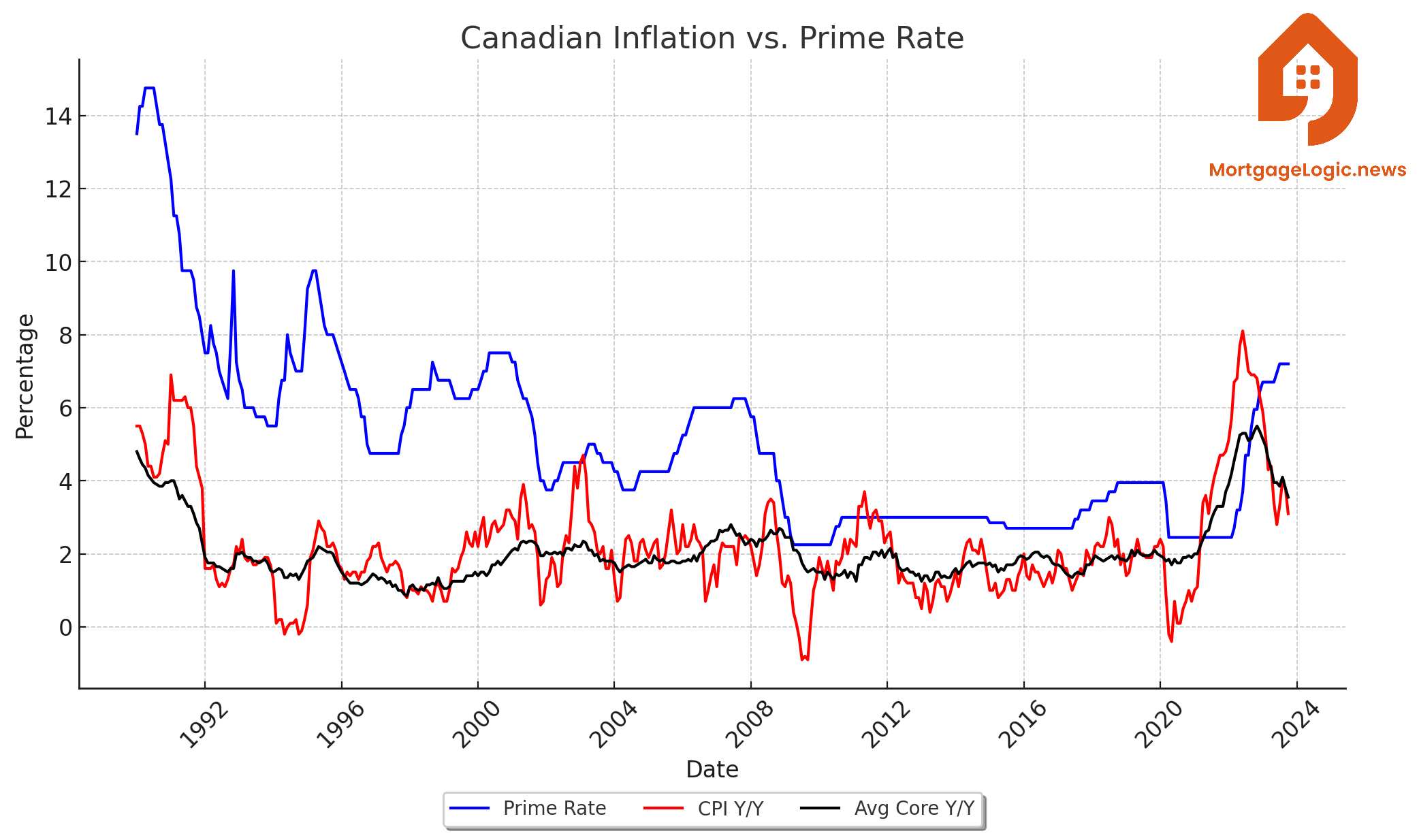

Inflation Cools Again. When Will Mortgage Rates Get the Memo?

Out of the myriad of economic data, #CPI# is what matters most. And we made solid progress today. The question is, when will mortgage rates catch on?

What CPI did

Headline inflation, which usually hogs the spotlight, fell to 3.1% in October from 3.8% the prior month.

But the bigger star was the BoC's closely watched 3-month average core inflation measure. It dropped to 2.95%, the best reading since early 2021.

The cherry on top was the month-over-month change. BMO Economics notes that "in s...