MLN NewsStream

Most Canadians don't pencil in U.S. Federal Reserve meetings on their calendars. But if they want to understand what's influencing their mortgage costs, they might consider it for 2024.

At Wednesday's meeting, #FOMC# members voted unanimously to keep America's top policy rate at 5.50%.

That should matter to mortgagors, given Canada's prime rate and the Fed funds rate are as synced up as Celine Dion's backup singers – a 0.93 correlation, to be precise.

Similarly, U.S. yields are like the North...

Mortgage Renewals: a Financial Freddy Krueger?

Some of the payment increases borrowers are seeing on renewal are a Nightmare on Mortgage Street—especially for folks without offsetting income gains.

But some of these predictions of renewal payment shock are getting a little dramatic.

The latest report to spawn worrisome headlines comes from RBC, who warns us to expect a "weighted average payment shock of 32-33%" for 2024 and 2025 mortgage renewals and "48%" for 2026. The barrage of similar studies this year has almost been desensitizing.

B...

Lenders Jump on Board with Insured Contract-rate Qualifying

Ever since OSFI revealed to the mortgage industry that it's possible to qualify an insured switch at the contract rate, lenders have been tripping over themselves to adopt the policy.

That's good news for non-deposit-taking lenders, like mortgage finance companies, which typically lead the pack on insured switch pricing. We expect that most of them will roll out support for contract-qualified switches. Already we've heard of multiple leading MFCs committing to it, including the big guns MCAP an...

An Insider's View from the Helm of Canada's Largest Residential MIC

There are big MICs, and then there are really big MICs.

Antrim Investments is the latter, reportedly the largest residential MIC in Canada with $1 billion in assets under management, a 50-year track record and 2,200 active loans.

We spoke with Will Granleese, Director and Portfolio Manager at Antrim, to determine what mortgage risks and opportunities he's seeing in the non-institutional lending world.

Here was his take......

The Market or BoC: Who Do We Believe?

Mortgage borrowers need rate relief like a desert hiker needs water, but the Bank of Canada is keeping rate cuts a mirage with no oasis in sight.

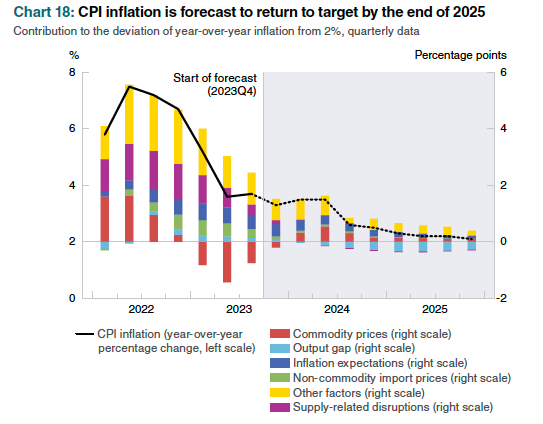

The BoC extended its rate pause today as expected—but moved the goalposts. The Bank now projects "that inflation will stay around 3½% until the middle of 2024," it said. That's up from 3% in its previous July forecast.

The Bank essentially implies it has a worse grip on inflation than it's been leading us to believe.

But the market isn't buying it....