MLN NewsStream

For weeks, the buzz in bond circles has been dominated by speculation the U.S. 10-year Treasury would hit 5%.

It finally did just that on Monday—for the first time since 2007—before collapsing by yesterday's close.

Its u-turn lower was forceful, resulting in a key reversal on the daily chart (typically a harbinger of a new downtrend). Coinciding with the move was talk of massive bond shorts unwinding their positions—i.e., buying back bonds and driving down yields.

Such technical trading pheno...

Equitable Bank Introduces 40-Year Non-Stress-Tested Mortgages

Nowhere do you hear more mortgage horror stories than in the Wild West of private lending.

Stories abound of private lenders hitting borrowers with egregious fees or suddenly demanding repayment from borrowers who've paid as agreed but have few other options. Indeed, while private lenders are a lifeline to some borrowers, they're perilous if you get in bed with the wrong one.

Equitable Bank wants to help Canadians access the right lender. It sees a need to make private lending more transparent...

Block RBC's Takeover of HSBC to Save Mortgage Competition: Poilievre

The Competition Bureau fed Canadians to the wolves when approving RBC's takeover of HSBC, and Conservative Leader Pierre Poilievre wants people to know it.

“We have far too much" concentration in mortgage lending, Poilievre told BNN Bloomberg today. "We have these monstrous, government-protected behemoths that dominate 90% of the mortgage market, meaning very little choice for consumers."

“Competition does not happen when the biggest player simply swallows the seventh-biggest player and Canadi...

OSFI Uncovers Little-Known Stress Test Exemption

Buried in OSFI's consultation feedback on Monday was this line:

"Insured borrowers...are exempt from the re-application of the MQR when switching lenders at renewal."

Most mortgage advisors know that this switch exemption applies to grandfathered mortgages—e.g., insured mortgages that closed before November 2016. But, hold onto your amortization tables, folks, because here's a lesser-known fact that's leaving even the savviest mortgage gurus scratching their heads....

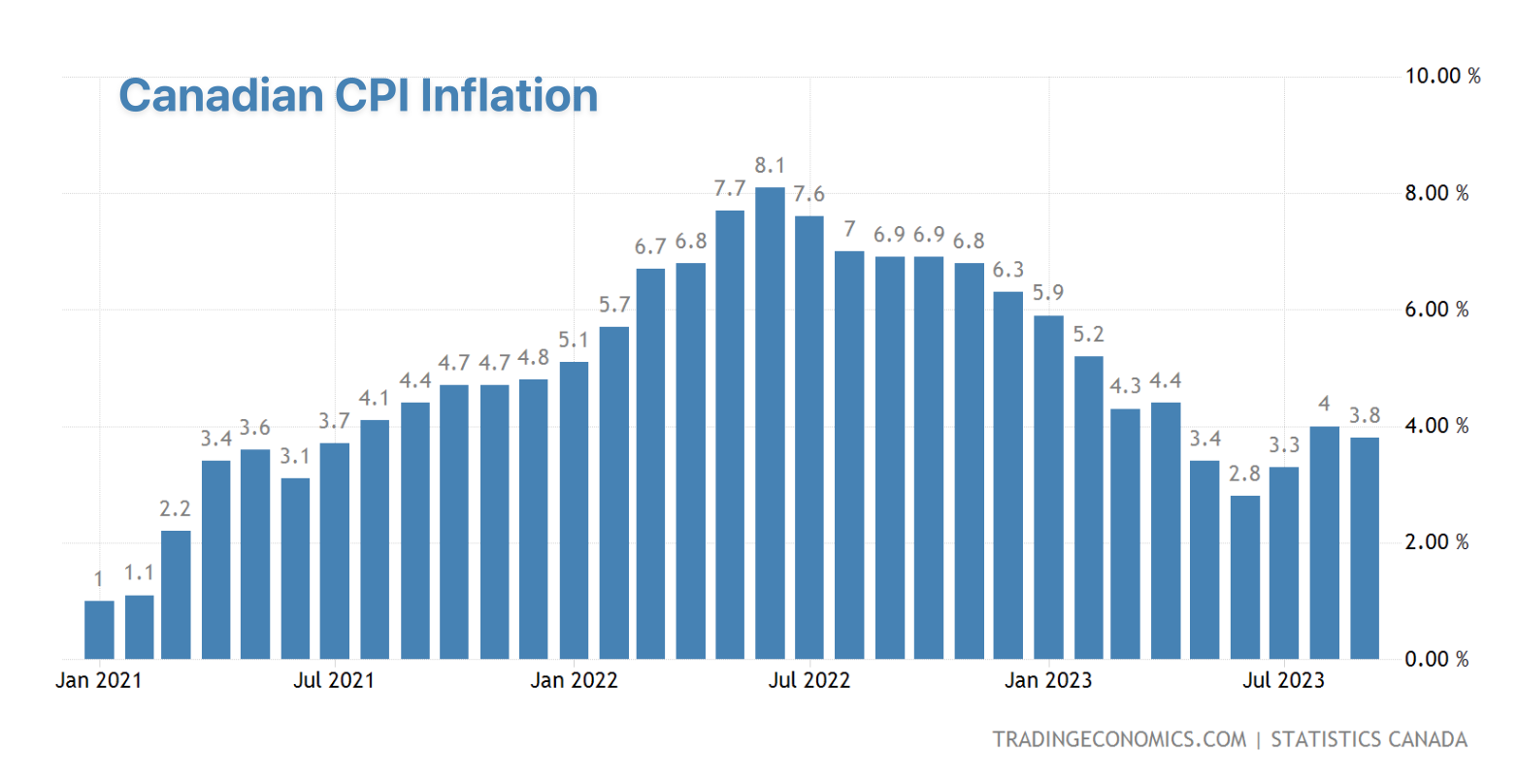

Surprise CPI Slowdown Gives Borrowers Hope the Rate Pause Will Last

Every month, Bay Street economists play a game of economic bingo, and this month, they had their dabbers ready for a 4.0% inflation print. Instead, StatsCan pleasantly surprised us with 'just' 3.8%.

Almost all of Canada's economist herd is now moving in the same direction, predicting no change at the Bank of Canada's Oct. 25 rate meeting. Most forecast the next BoC move will be a cut.

Meanwhile, bond traders played their own game of Rate Hike roulette, slashing rate increase probabilities. By...