MLN NewsStream

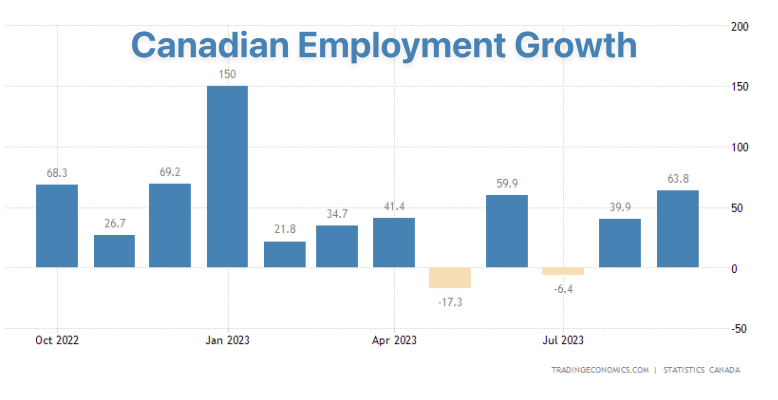

The cat's out of the bag. All the monetary tightening to date may not be enough—not if today's stunning job growth is any indication.

But don't worry, "just sit tight," central banks advise us. "Monetary policy takes time" — like waiting for your internet to load a video in the 90s.

Okay, sure, but those same central bankers have virtually no control over two critical drivers of today's hot employment data: fiscal and immigration policy (more on those below).

Markets have been holding their b...

Pine Mortgage Buys a New Lead Funnel: Properly.ca

Remember Properly, that realty site that made guaranteed offers to home sellers?

What a great idea that was...until it wasn't.

Earlier this year, Properly ditched its "Sale Assurance" offering, its claim to fame, due to “unprecedented volatility in the Canadian housing market.” And there went its dreams of "transforming" the Canadian real estate industry.

When the curtains finally closed, Properly was sold for its most valuable remaining asset: its website. And, swooping in to scoop that up—a...

Mortgage Rates: Still Climbing or Afraid of Heights?

The other day, I heard a bond trader irreverently explain bond market action by coining the acronym: ISS.

a.k.a. "It's supply, stupid."

What it means is that bond traders are rapidly recalibrating their rate expectations, given the avalanche of supply hitting the government debt market, and expected to hit it.

Meanwhile, reckless overspending in Washington and Ottawa keeps pouring more gas on the fire—boosting both bond issuance and inflation.

Now, when it comes to when rates will peak, MLN...

OSFI's Worry-o-Meter Peaks on Commercial Lending

ℹ️Reader note: Due to the holiday, the latest Amortization Simulator will be available Tuesday evening, once we receive the latest forecast curve data from CanDeal DNA.

Today's Mortgage Bytes follow below.

Canada's banking watchdog is increasingly nervous about lender exposure to commercial real estate (CRE).

It's so uneasy that it just sent banks its first-ever formal, public guidance on risk management for CRE lending.

"Commercial real estate is a top risk as outlined in OSFI’s April Ann...

How Paying Off Your Mortgage Quicker Could Make You Retire Poorer

💡MLN's latest Mortgage Bytes follow below.

The other day a Global News newsletter subscriber stopped me on the cyber-street and asked if accelerating principal repayment is worth it. I'm sharing the answer here in case readers come across similar questions...or need an idea for a client CRM email.

The Question:

"I’ve heard that trying to pay down your mortgage is a financial myth. You need only pay your interest, and when you sell your house, the increased equity will put you further ahead...