MLN NewsStream

Ontario's mortgage broker regulator (FSRA) feels mortgage shoppers need more protection from bad advice. So it commissioned this survey, which it plans to use when developing new broker guidelines this fall.

Mortgage suitability is also on the radar of other provincial regulators. We have comments from some of them below.

But first, here's what FSRA's survey revealed......

Lost and Found: Scotiabank Finds its Way Back to the Mortgage Broker Market

As mortgage brokers are painfully aware, the channel's former undisputed #1 lender—Scotiabank—pulled way back from the space last year.

Despite mortgages being an anchor product for the bank, it said it needed to reassess its entire approach to real estate secured lending in order to manage its balance sheet.

This week, the nation's third-largest bank finally made its triumphant return—chopping broker rates and putting it back in contention with archrival TD.

The move was met with fanfare...

Navigating Through the Noise: Borrowers Must Trust the Bank of Canada's Long Game + Mortgage Bytes

0:00

/1:49

1×

So many mortgagors are tapped out. They're imploring the rate gods at 234 Wellington Street for cuts.

Much to their irritation, forward pricing in Canada's bond market isn't cooperating.

OIS data from Bloomberg now imply:...

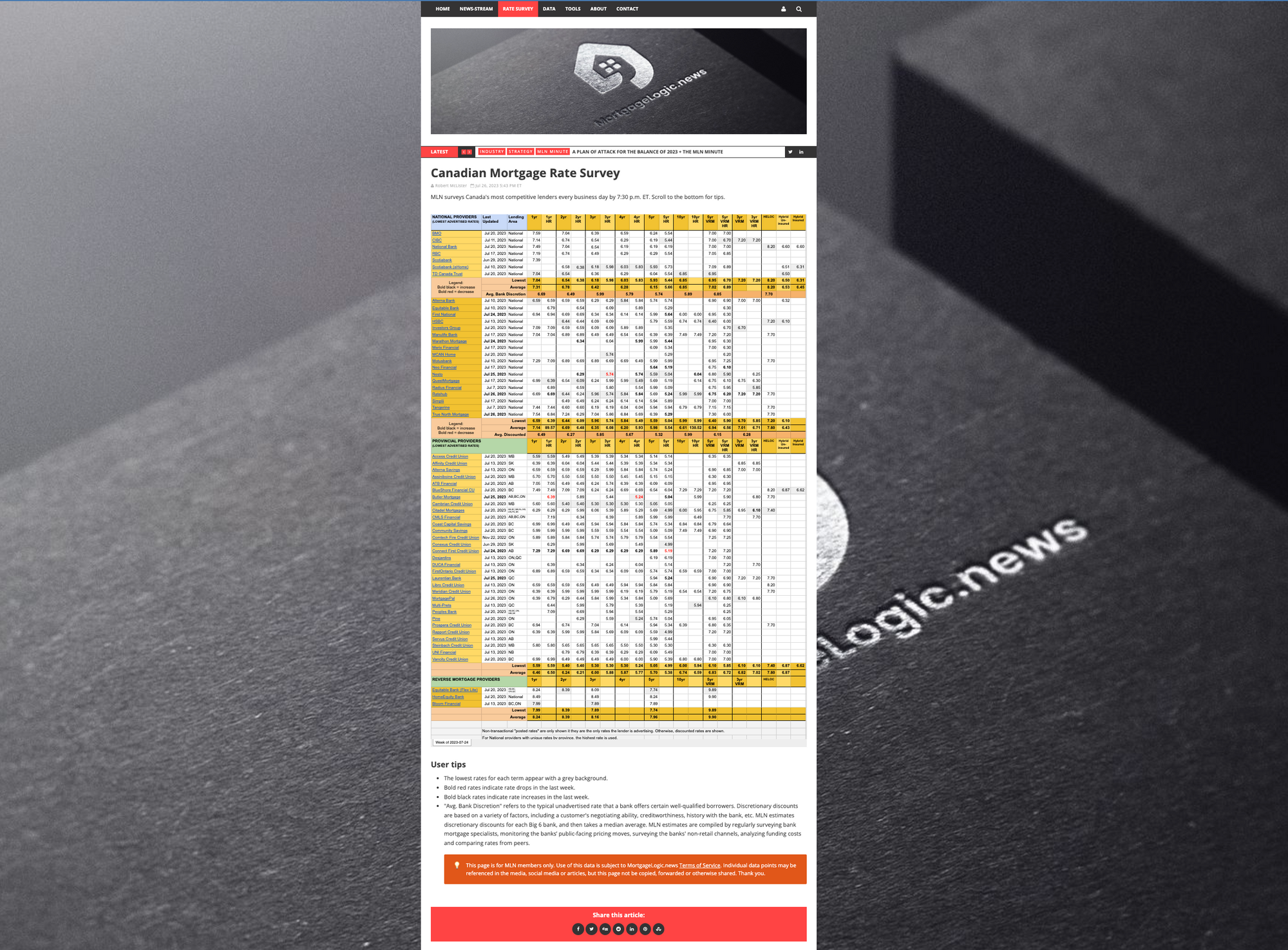

NEW: MLN Launches Canadian Mortgage Rate Survey

Members now have direct access to MLN's daily rate database—the same data we use to track and report rate trends in the prime mortgage market.

View it at Canadian Mortgage Rate Survey.

The data has many uses, particularly for mortgage providers employing a spread pricing strategy.

Such originators systematically set their rates to be X basis points above the market's "leading rates." The problem is, "leading rates" can be subjective.

Quantifying rate competitiveness is where the Rate Su...

Fed still trying to break inflation

...