MLN NewsStream

💡"Focus on the central banks, and focus on the movement of liquidity... most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets."

—Billionaire former hedge fund manager, Stanley Druckenmiller

The liquidity tap in the world's biggest economy will close a bit tighter today.

The U.S. Federal Reserve is queuing up today's—and possibly one more—hike before taking a potentially permanent break....

Government’s Mortgage Exposure Dwindles, But Who’s Counting? (Opinion) + Mortgage Bytes

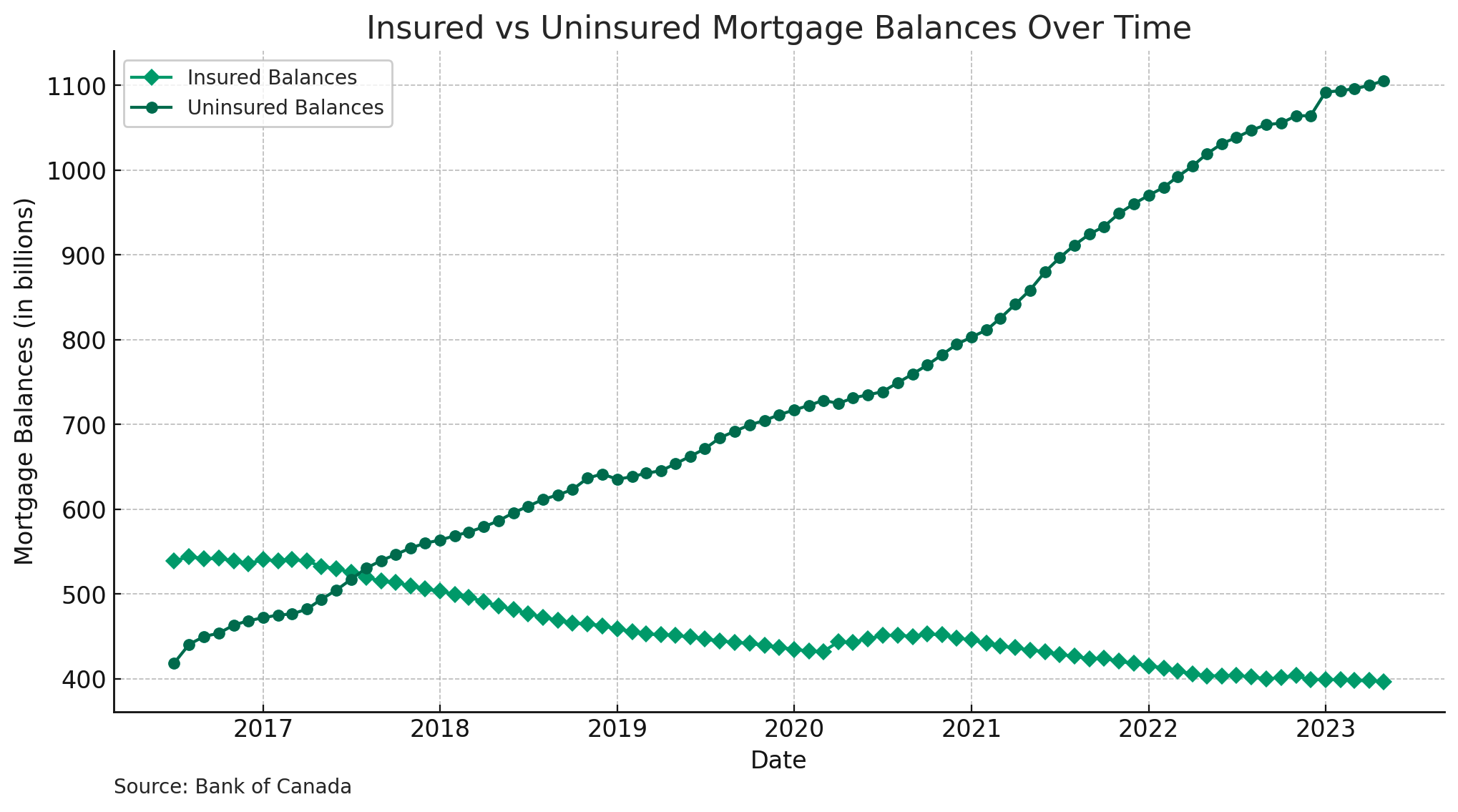

The gap between insured and uninsured mortgage originations is now wider than the Grand Canyon. And it just keeps expanding, as the BoC's latest data show (chart below).

The government seems blissfully content to let the insured market wither.

The number of mortgages on CMHC's books, for example, is now below 1.5 million for the first time in over a decade. That's down one million in just six years. (There are roughly seven million mortgages in Canada total.)

Meanwhile, despite 11 years o...

Mortgage Renewals. What to Prepare For and How

...

A plan of attack for the balance of 2023 + The MLN Minute

...

ChatGPT Strategy for Mortgage Content. A 1-on-1 with Neil Patel

Neil Patel is an SEO Jedi and content wizard. The Wall Street Journal calls him one of the world's top marketing influencers.

Patel consults for companies like Google, Facebook and Intuit and has (at @neilpatel) over 1.1 million YouTube subscribers.

He recently spoke with us about a little invention called ChatGPT — and how it should and should not be used for mortgage content marketing.

The questions he answered have been on our minds for months, including:

* How should mortgage profes...