MLN NewsStream

In a competitive mortgage market, brokers sometimes have to take the road less travelled. That includes trying lenders they wouldn’t usually think of.

One lender that most brokers don’t think of is Shinhan Bank Canada, a subsidiary of Korea’s second-largest bank by assets. But it may pay to keep it in mind, and here's why....

BoC sends housing market a message. Hikes 1/4-point

The Bank of Canada has sucker-punched rate floaters and the real estate market with a 25 bps rate boost.

In one swift statement, it has decidedly reset rate expectations. Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December. Another move would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001)....

The latest from RateLand

According to a Reuters poll last week:

* 24 of 28 economists expect no change at Wednesday's BoC meeting.

* Two-thirds expect no further overnight rate changes at all this year.

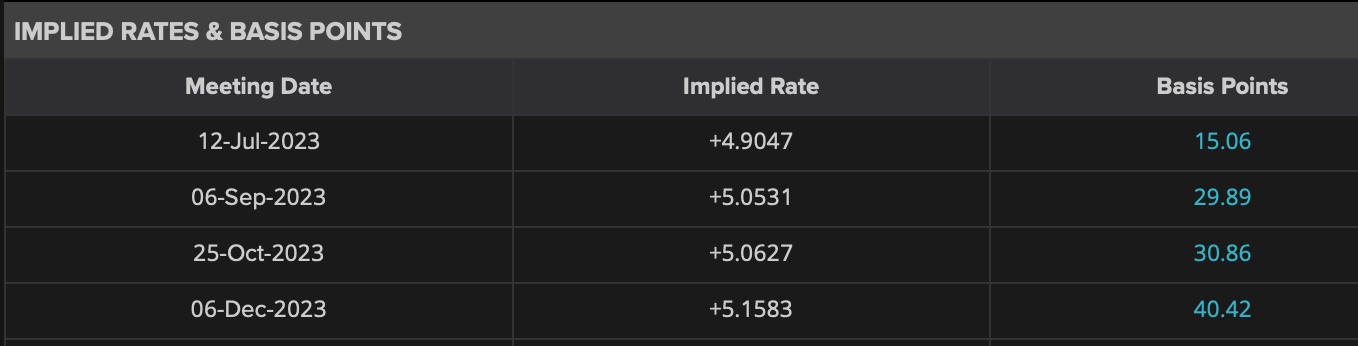

That's in clear defiance of market pricing (see table below). And the market is slightly more accurate than economists over the long run....

All eyes on Wednesday's BoC verdict

The Bank of Canada's job isn't done—judging from the hike and a half now priced into the #OIS# market this year.

Markets see what the BoC sees: stubborn perkiness in labour, services and housing markets, with core inflation plateauing.

The Bank of Canada knows rates are restrictive but worries they're not restrictive enough. Real rates are still low compared to pre-#GFC# rate cycles. And if the late 1970s (chart above) taught central banks anything, it's that they can afford only so much patie...

Rocket Mortgage Canada (the lender) takes flight Monday

Multiple online brokers have launched in-house lenders in recent years. But this one's different.

This one is Rocket Mortgage Canada, sister company to Rocket Mortgage, the largest retail lender in the United States, with $133 billion (USD) in originations last year.

Rocket Canada's shiny new lender launches on Monday, and it's got the brand and backing to make an impact in Canada's mortgage space. To learn how much of an impact, MLN spoke with Hash Aboulhosn, Co-Founder & President of Windsor...