MLN NewsStream

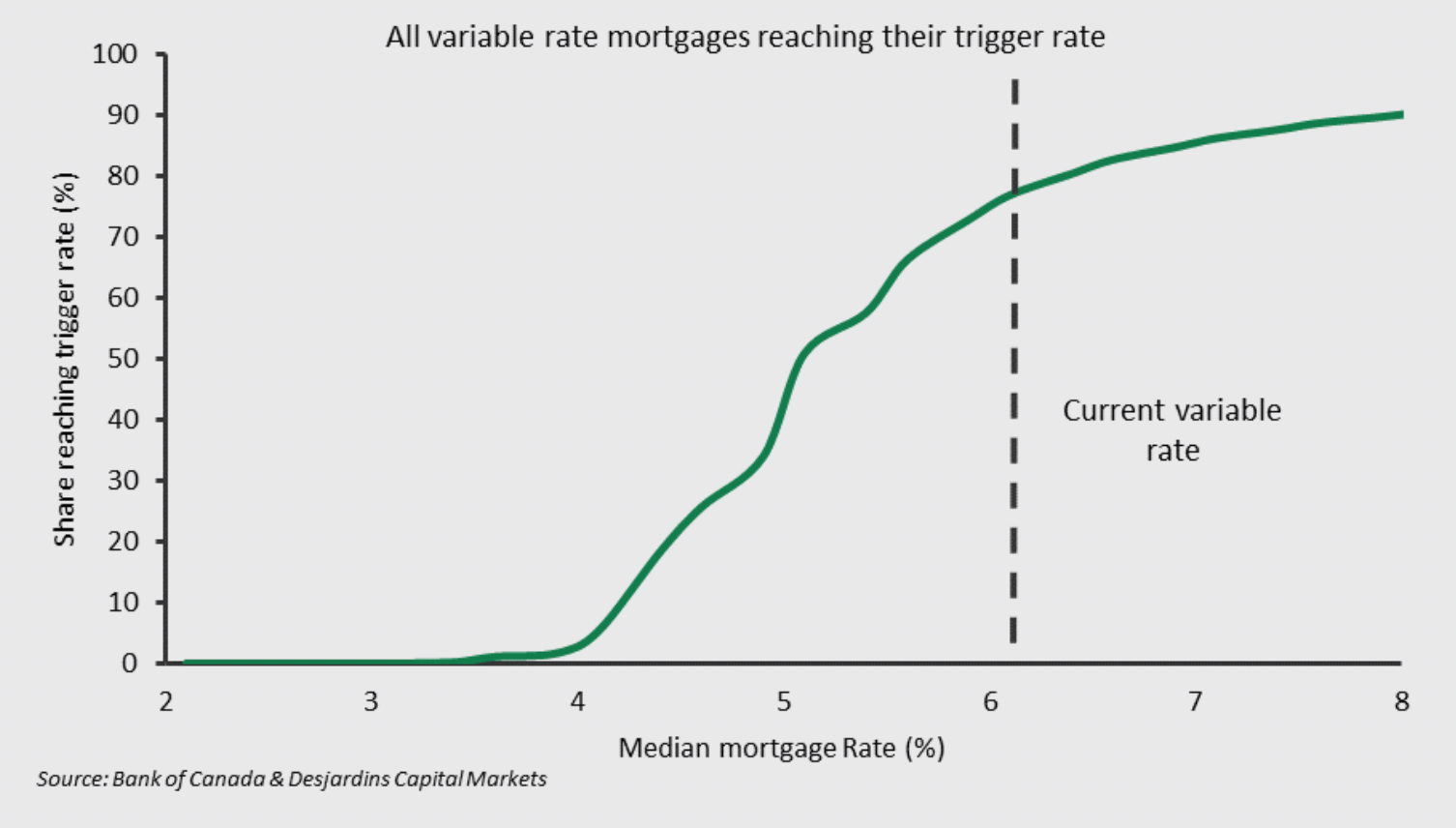

* Trigger risk fades: Of the 1 in 3 mortgages with floating rates, about 75-80% have fixed payments, and about "three-quarters" of fixed-payment variables have hit their trigger rate, estimates Desjardins Economics. The BoC's pause has eased trigger rate concerns, but if rates do resume higher "a number of financial institutions have disclosed that they will allow the principal owed to grow to 105% of the original loan value before requiring any additional payments," Desjardins said Monday. "Th...

The Value Zone

Canada's mortgage rate market has been deader than a mausoleum. Leading 5-year uninsured rates haven't changed for weeks, and the only nationally-best offer that moved this week was the insured 4-year fixed, up five bps.

Mortgage rates have been in limbo largely because yields are stuck in a channel, searching for direction....

The latest from Rateland

When a central bank stops hiking rates, there inevitably come times when they second-guess themselves. Today is going to be one of them.

The real estate numbers that CREA just dropped displayed a resilience that doesn't jibe with 300-425 bps of rate increases and potential recession. BoC governor Tiff Macklem, who's already publicly stated his upside rate bias, will take notice.

Let's get to the highlights:...

Another major bank is entering the broker channel

Some have called it the worst-kept secret in the mortgage industry. Now, the secret is reportedly becoming a reality.

While not official yet, here's what we've been told thus far......

CMHC CEO pooh-poohs long-amortizations: Opinion

CMHC CEO Romy Bowers told the Globe and Mail this week that she's against extending insured amortizations beyond 25 years.

“It’s better to focus on increasing the supply versus making it easier for people to borrow more money," she said. "We feel, from a policy perspective, it’s probably not the best move in a supply-constrained environment."

And she may be right.

But to be clear, she's essentially saying she doesn't think longer amz are a good idea anytime soon—because supply isn't about to...