MLN NewsStream

Back in the day, appraisers dealt with only a handful of lenders. Today they deal with dozens.

That means appraisers must know far more lender specifications, like how old comparables can be, what sort of comps to use, etc.

All these different lender rules boost the chances appraisers will get something wrong when drafting appraisal reports....

JUST IN: OSFI speaks on its upcoming B-20 changes

The banking regulator's Assistant Superintendent, Tolga Yalkin just spoke at a C.D. Howe Institute event in Toronto.

We wanted to pass along some of his quotes (highlighted below) straightaway......

Bank of Canada holds firm at 4.50%. The mortgage implications

📰ICYMI: For anyone interested in the mortgage broker business, MLN's interview with industry leader Luc Bernard is a must-watch. View now

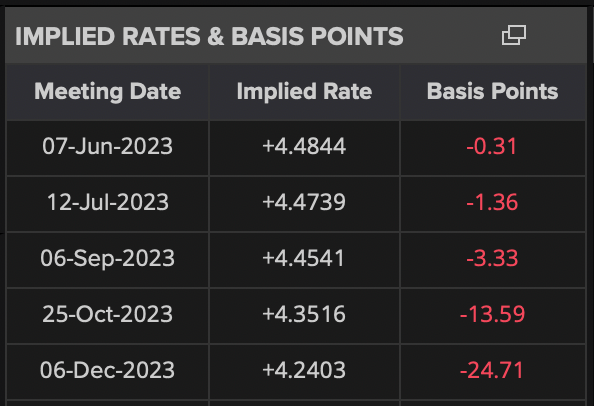

Markets predicted the Bank of Canada would leave its key rate at 4.50%, and it did.

"We've come a long way" since last summer, BoC governor Macklem said today. "We are encouraged inflation is declining..."

What matters most for mortgage rates, however, is not where we've come from, but where we're going. The Bank shared these clues in today's official stat...

Talking shop with M3's Luc Bernard

Few entities in Canada originate more mortgages than M3 Mortgage Group. Its Founder & CEO Luc Bernard, therefore, knows more than your average bear about running a profitable mortgage operation.

With broad industry connections and access to a wealth of data, Luc intimately understands the trends driving Canada's mortgage business. That's why we wanted to interview him. MLN's discussion with Luc yielded an abundance of learnings, including new insights into:

1. Another major bank entering the...

Immigration policymakers catch heat

The Globe published yet another criticism of federal immigration policy today, as it relates to creating housing imbalances (that story).

Politicians are about to see far more coverage of this issue as Canadians get fed up with newcomers driving their housing costs higher, let alone taxing health care and education systems. Surveys show that most Canadians are pro-immigration, as they should be, but there's a limit.

From a housing standpoint, heat in the press will result in one of three outco...